The stock market is a sophisticated, multidimensional system that plays a vital role in the world economy. The fundamental component of the stock market is a group of exchanges and markets where regular transactions involving the purchase, sale, and issue of shares of publicly traded businesses occur. Formal exchanges or over-the-counter (OTC) marketplaces that follow specific rules are used for these financial transactions. Facilitating the transfer of funds from investors to businesses in need is the main goal of the stock market. An initial public offering (IPO) is the procedure by which businesses list their stock shares on an exchange in order to raise money from the general public.

Stock Market Role in the Economy

As a gauge of the state of the economy and a catalyst for the generation of wealth, the stock market is essential to it. It provides various important means for economic growth.

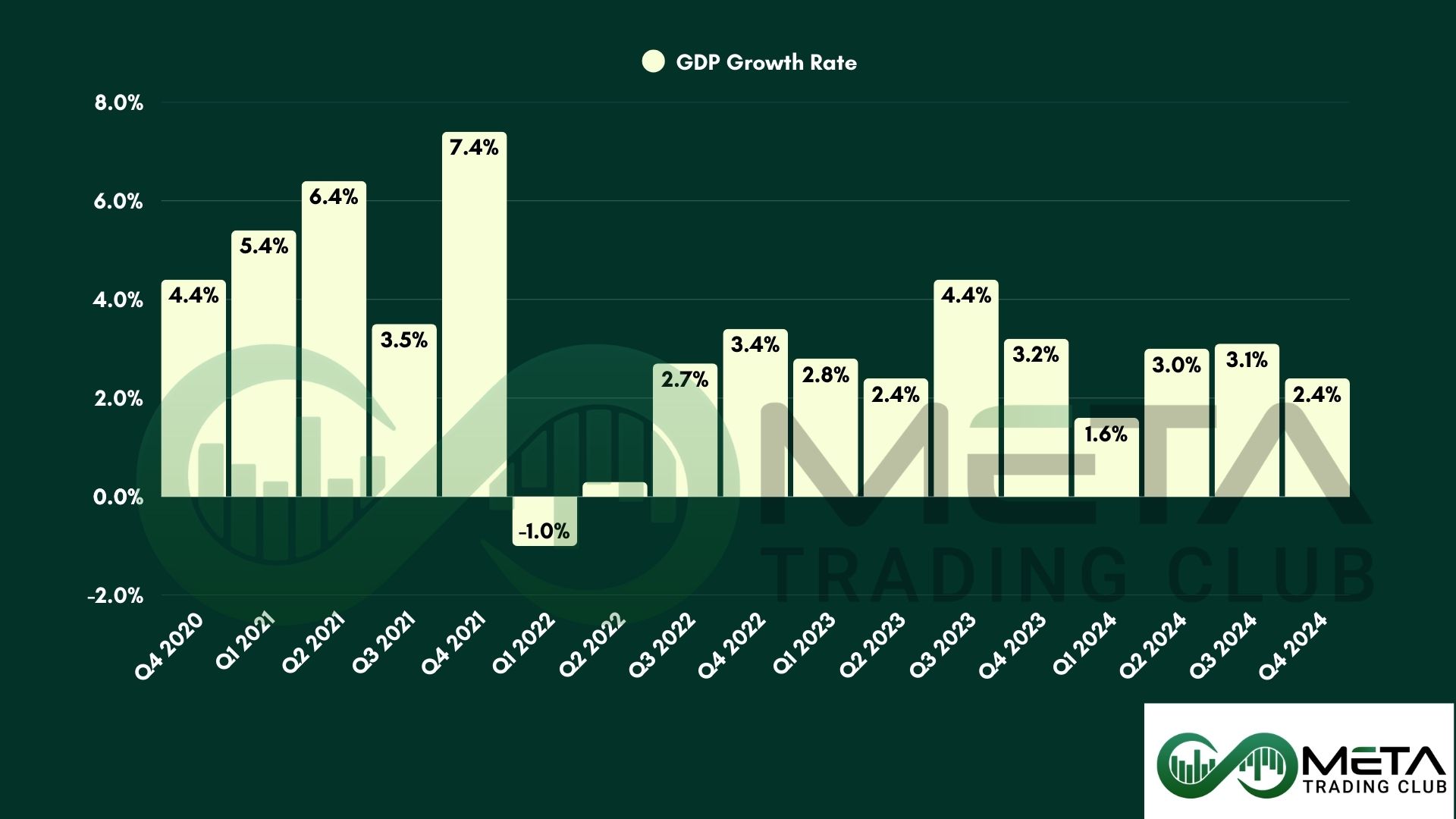

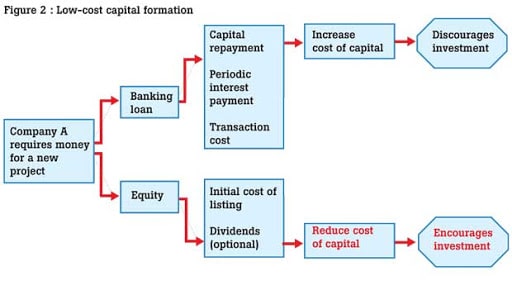

Formation of Capital

By acting as a channel for capital formation and allowing companies to raise money by selling shares to the general public, the stock market is vital to the economy. Through initial public offerings (IPOs) and secondary offers, this procedure enables businesses to raise capital without taking on debt, giving them the money they need to expand their operations, innovate, and engage in profitable ventures. As such, this capital infusion supports the expansion of individual businesses as well as the improvement of technology, productivity, and employment creation, all of which contribute to the overall economic development.

Wealth Distribution

The stock market plays an important role in wealth distribution because it provides a platform for both individuals and institutions to invest in equities, allowing them to partake in corporate earnings. This investing strategy democratizes wealth accumulation, allowing a wider range of people to benefit from economic growth and corporate success. Dividends and capital gains allow investors to see a return on their assets, leading to a more equal distribution of wealth by sharing company profits with a broader spectrum of economic actors.

Liquidity

Liquidity in the stock market is an important factor that increases the appeal of investing in stocks. It enables investors to purchase and sell shares without generating large price fluctuations, allowing them to quickly enter or exit holdings based on their investment plan or financial needs. This high level of liquidity lowers the danger of being unable to sell an asset at a reasonable price, making stocks a more tempting investment option. By offering a platform for efficient share trading, the stock market allows investors to handle their investments more freely and with greater confidence in the liquidity of their assets.

Price discovery

Price discovery in stock markets is a fundamental process that determines stock prices based on supply and demand. This dynamic process represents investors’ aggregate evaluations of a company’s current performance and potential for future growth. As investors purchase and sell shares, their actions, influenced by information, speculation, and expectations about the company’s future, contribute to the market price of the stock. This price is an important indicator of a company’s perceived value at any given time, impacting investment decisions as well as corporate plans and economic policies. Stock markets play a significant role in allocating resources in the economy, moving capital towards the most efficient uses based on perceived value and growth prospects of companies.

Corporate Governance

Corporate governance in the context of publicly listed organizations entails a set of strict reporting criteria and governance standards that these companies must adhere to. This regulatory system aims to enhance responsibility, efficiency, and transparency in the corporate sector. These policies seek to safeguard investors, improve market integrity, and raise investor trust by requiring frequent financial disclosures, compliance with ethical standards, and adherence to fair practices. Corporate governance focuses on responsible management and monitoring, urging businesses to act in the best interests of their shareholders and other stakeholders. As a result, the financial markets and the economy as a whole benefit from increased health and stability.

Enabling the Purchase and Sale of Stocks

An organized and controlled setting is offered by the stock market, where investors can buy shares in businesses they think will appreciate in value over time. Purchasing stock entitles an investor to a portion of the company’s profits as well as any voting rights that may be associated with the stock.

Stock exchanges, like the New York Stock Exchange (NYSE) and the NASDAQ, facilitate buying and selling by offering the necessary technology and a secure environment for these transactions to take place

Facilitating Businesses to Raise Funds

Businesses can access a large pool of potential investors when they list their stock on an exchange, which helps them raise the money they need for expansion and growth. By avoiding debt, this approach not only helps the businesses by giving them the money they need, but it also makes it possible for regular people to purchase stock in these businesses and share in their financial success.

Stock exchanges, like the New York Stock Exchange (NYSE) and the NASDAQ, facilitate buying and selling by offering the necessary technology and a secure environment for these transactions to take place

Participation in Financial Success

There are two primary ways that stock market investors might profit financially: through dividends and capital gains. When an investor sells a stock at a profit and its price rises above the acquisition price, they have realized a capital gain. A portion of a company’s profits that it chooses to provide to its shareholders is known as a dividend, and it typically happens once a quarter.

In conclusion, the stock market plays a vital role in economic growth by acting as a link between businesses in need of funding and investors hoping to increase their wealth. The stock market participates in price discovery, corporate governance, liquidity provision, and capital generation, all of which contribute to economic efficiency and growth.

Meta Trading Club is a leading educational platform dedicated to teaching individuals how to trade and invest independently. Through comprehensive educational programs, personalized mentorship, and a supportive community, Meta Trading Club empowers traders to navigate financial markets with confidence and expertise.