Last week’s market and economic data key points:

- Consumer sentiment hit 1990-level decline

- Inflation expectations soared to 6.5%

- Trump eased China tariffs boosted stocks

- Tech sector led S&P 500 weekly gains

- Tesla surged 18% as Musk refocuses on leadership

- Google posted Strong earnings thanks to AI

- ServiceNow rocketed 22% on AI-driven growth

- Palantir jumped 20% with new contracts

- Netflix gained 13% on subscriber growth

- Gold dropped with 3% weekly loss

- Oil fell due to supply fears

- Dollar logged first weekly gain since March

- Euro slipped near $1.13 amid dollar rallied

- Sterling gained 5% since April streak

- Bitcoin ETFs attracted $3 Billion inflows

Table of Contents

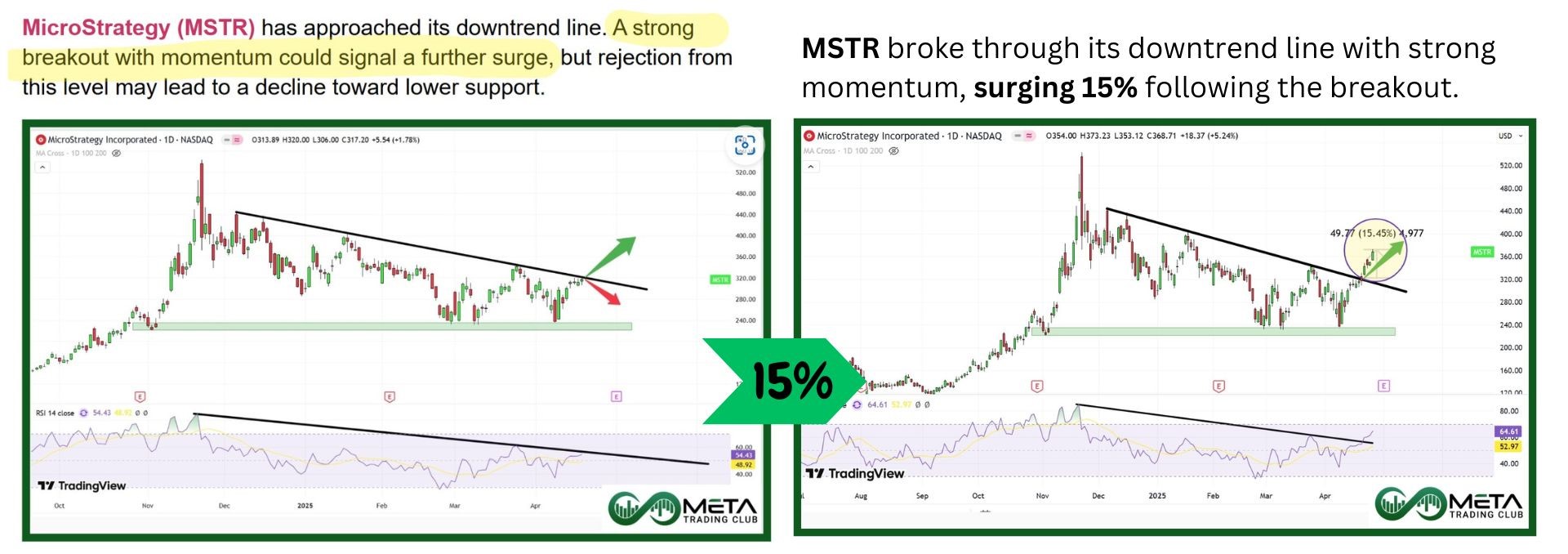

What You Gained by Reading Last Week’s Market Mornings and What You Missed If You Didn’t!

Last Week’s report

Economic Reports

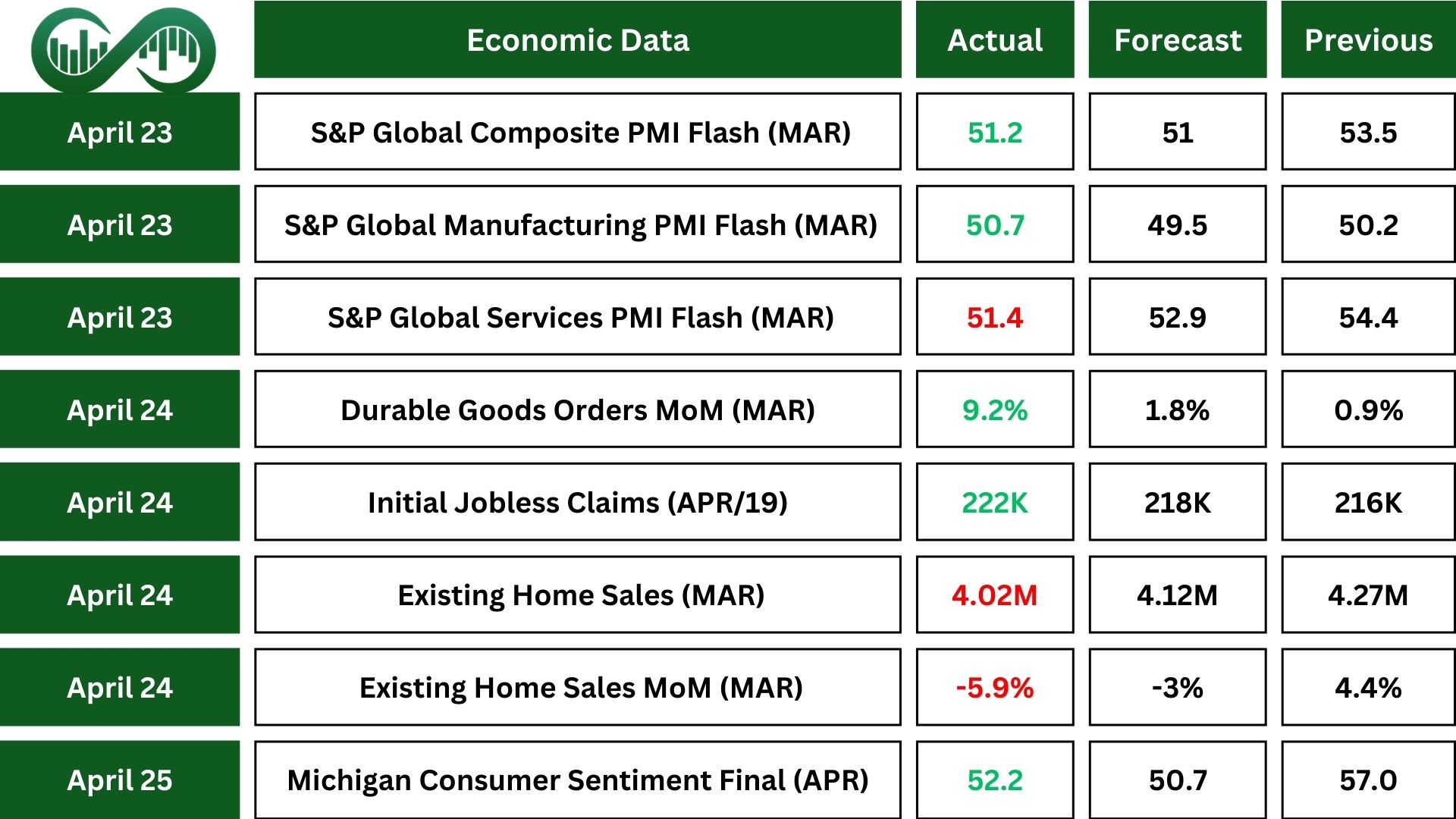

The S&P Global US Manufacturing PMI rose to 50.7 in April, beating expectations and marking four months of slight growth. Production improved, and domestic orders increased, but export orders fell due to tariffs. Companies cut jobs for the first time since October, while rising tariffs and supply issues pushed costs and inflation to a 29-month high. Business confidence dropped to its lowest since last August amid concerns over rising costs, supply shortages, slow growth, and weak export demand.

In March 2025, U.S. Durable Goods Orders jumped 9.2% to $315.7 billion, far exceeding expectations, thanks to a 27% surge in transportation equipment, including a 139% rise in nondefense aircraft orders. While this indicates strong demand and potential growth in manufacturing and transportation sectors, orders excluding transportation remained flat, highlighting limited broader economic momentum.

U.S. Initial Jobless Claims rose to 222,000 in the third week of April, meeting expectations. Continuing claims fell to 1.84 million in the second week of April, also hitting a two-month low and coming in below forecasts. This highlights the labor market’s tightness. Meanwhile, federal employee claims increased slightly, as severance packages delayed some benefits.

Consumer sentiment dropped for the fourth straight month in April, falling 8% from March and 32% since January, the steepest decline since 1990. Expectations worsened across demographics due to concerns about trade policy, inflation risks, and slow income growth, which could weaken spending.

Year-ahead inflation expectations surged to 6.5%, the highest since 1981, reflecting uncertainty despite a partial pause on tariff hikes earlier in the month.

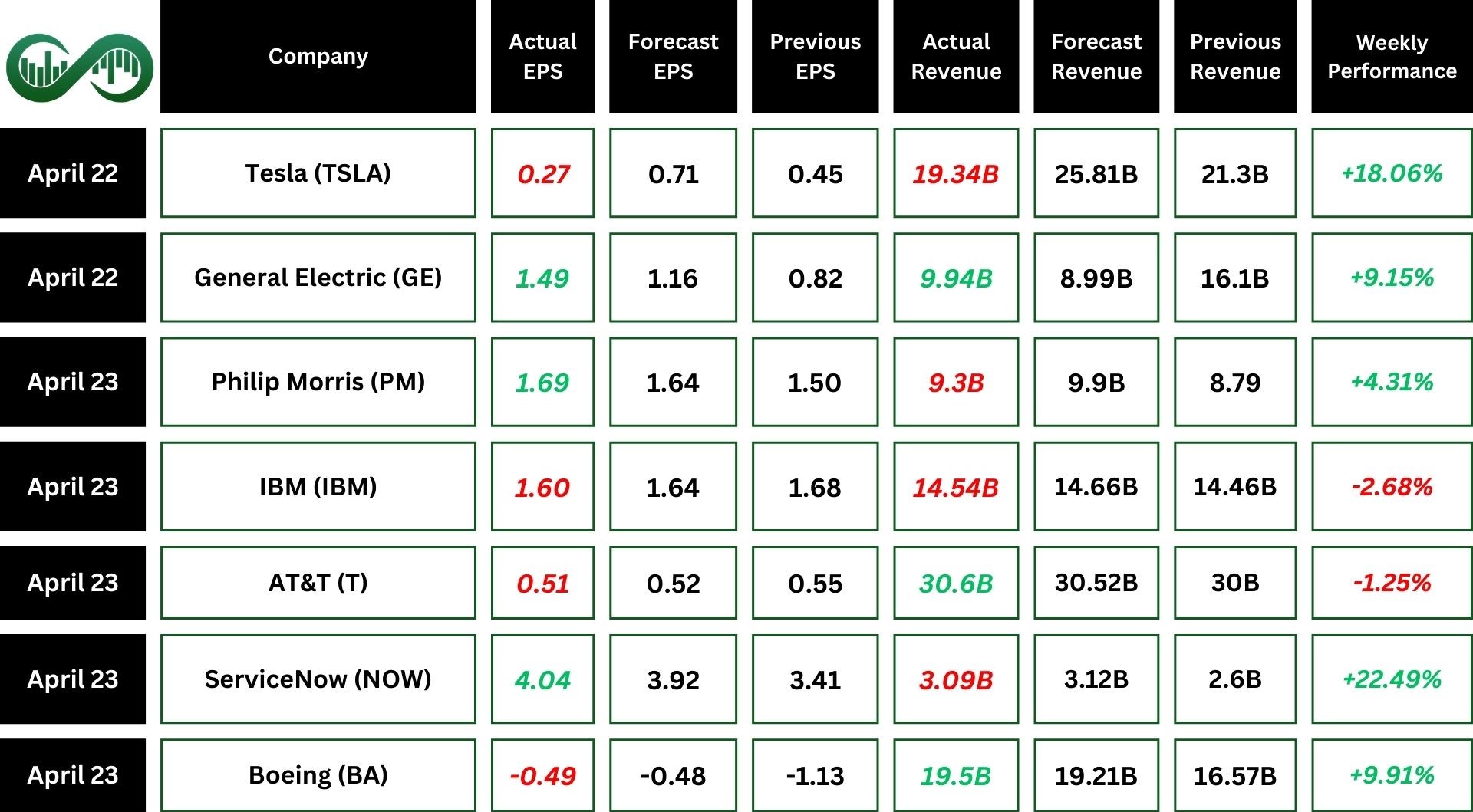

Earnings Reports

Tesla

Tesla (TSLA) first-quarter earnings and revenue fell short of expectations. While its services and energy storage segments showed solid growth, electric vehicle sales dropped 13% from January to March.

The company faced setbacks like protests, boycotts, and falling sales in key markets, partly linked to Elon Musk’s political ties. Tesla’s stock has nearly halved since December, and plans for a budget model were canceled in favor of cheaper variants.

Affordable Model Y production was delayed, and driverless ride-hailing services face legal obstacles.

Analysts forecast another annual drop in Tesla deliveries for 2025. Tesla also recalled Cybertrucks, introduced a lower-cost version, and discounted unsold vehicles, while tariff disputes with China added further strain to operations. The company also revealed capital expenditures could exceed $10 billion this year, with trade policy changes potentially affecting project timelines.

Tesla shares surged 18% last week after Elon Musk announced he would shift his focus back to Tesla, reducing his role in federal budget cutting.

Technically, TSLA surpassed its short-term downtrend line, gaining momentum and Surged 11% following the breakout.

General Electric

GE Aerospace (GE) had a strong Q1 2025, with orders up 12% and revenue growing 11% year-over-year. Profit rose by 13%, and adjusted earnings per share (EPS) surged 60%.

The company reaffirmed its full-year guidance, driven by high demand for commercial services and efforts to improve supply chain issues. GE plans to invest $1 billion in U.S. manufacturing and hire around 5,000 workers while continuing to optimize operations and manage costs for steady growth.

Technically, GE stock could climb higher if it breaks its downward trend in RSI momentum.

Boeing

Boeing (BA) delivered strong Q1 2025 results, with $199 million in adjusted operating profit and $19.5 billion in revenue, beating estimates.

Although it reported a 49-cent EPS loss, the company is projected to deliver 580 jets this year, recovering from earlier production setbacks.

Defense and services segments showed solid profits respectively. High demand for aircraft continues despite production challenges.

Boeing’s stock rose over 9% after the earnings report, supported by easing U.S.-China trade tensions, improved jet deliveries, and a growing backlog.

Technically, if BA stock breaks its downward trend line, it could surge further; however, a rejection at that line might lead to a decline.

Pepsi

PepsiCo (PEP) reported a Q1 profit of $1.83 billion, down from last year, with adjusted earnings of $1.48 per share missing estimates slightly. Revenue fell 1.8% to $17.92 billion.

PepsiCo also revised its 2025 forecast, citing higher costs and weaker consumer spending, and now expects flat earnings growth instead of mid-single-digit growth.

Alphabet

Alphabet (GOOG, GOOGL) delivered impressive Q1 2025 results, reporting $89.1 billion in revenue, a 12% year-over-year increase.

Google Search generated $50.7 billion and Google Cloud revenue grew 28%. YouTube ads rose 10% and Operating income increased 20%.

Net income grew 46%, and earnings per share rose 49% to $2.81.

Additionally, Alphabet raised its dividend by 5% to $0.21 per share and announced a $70 billion stock buyback, reflecting confidence in its financial stability and future growth.

Technically, GOOG has broken its downtrend line, and if bullish sentiment continues with strong confirmations, the stock may surge toward the $170 resistance level.

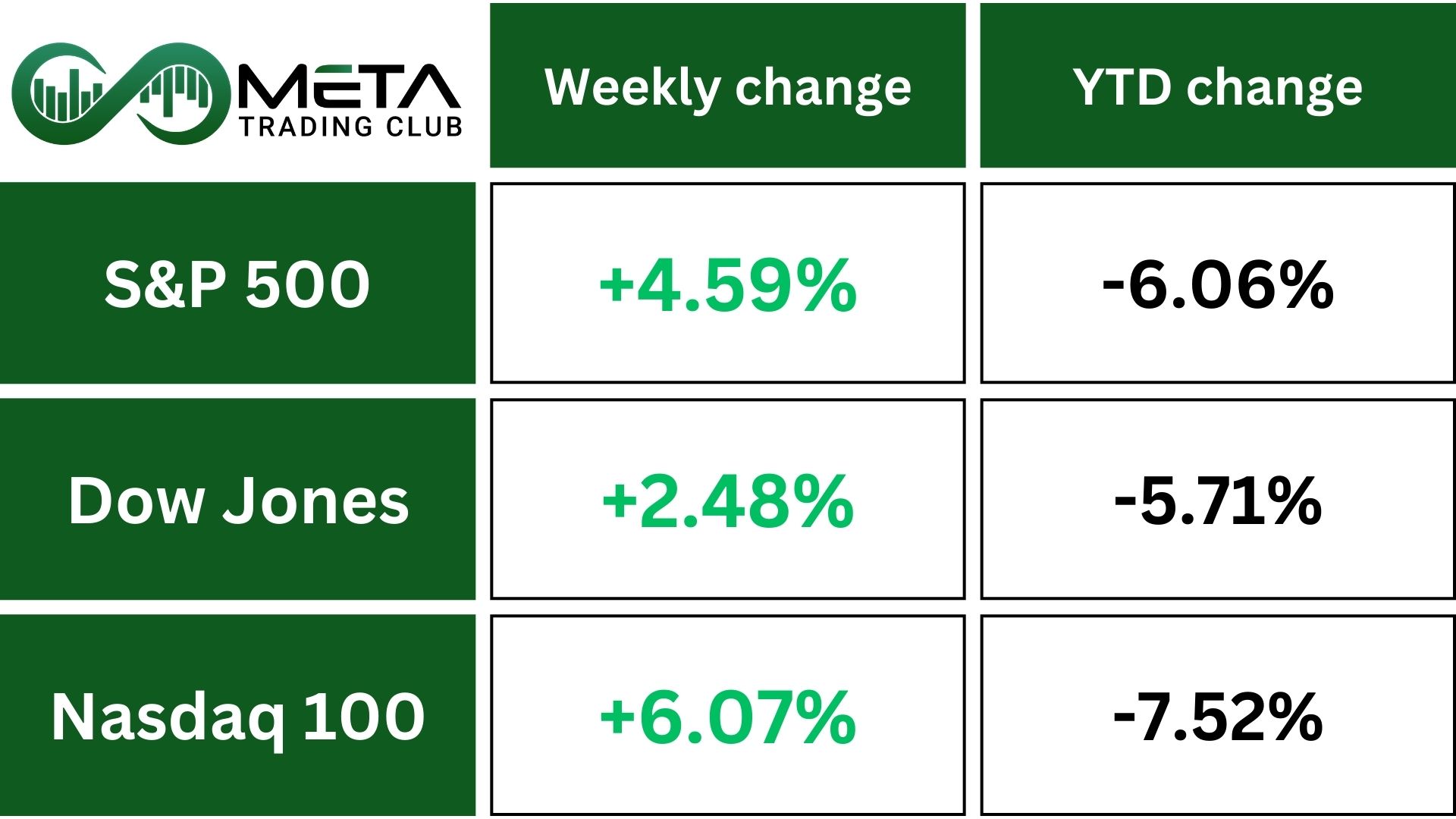

Indices

Indices’ Weekly Performance:

US stock indexes rose last week as the Trump administration eased trade tensions with China. The S&P 500, Nasdaq and Dow increased last week.

President Trump announced plans to lower the 145% tariffs on China and confirmed he wouldn’t remove Federal Reserve Chair Jerome Powell. This aligns with his earlier campaign promises of a 10% universal tariff and a 60% tariff on China.

These changes have caused a relief recovery, though the longer-term effects on the US economy remain uncertain.

Technically, SPX has broken its downtrend line and reached the 5500 resistance level. If the index secures confirmation above this resistance, it could surge further into the 5700-5800 range. However, a rejection at this level may result in a decline.

Stocks

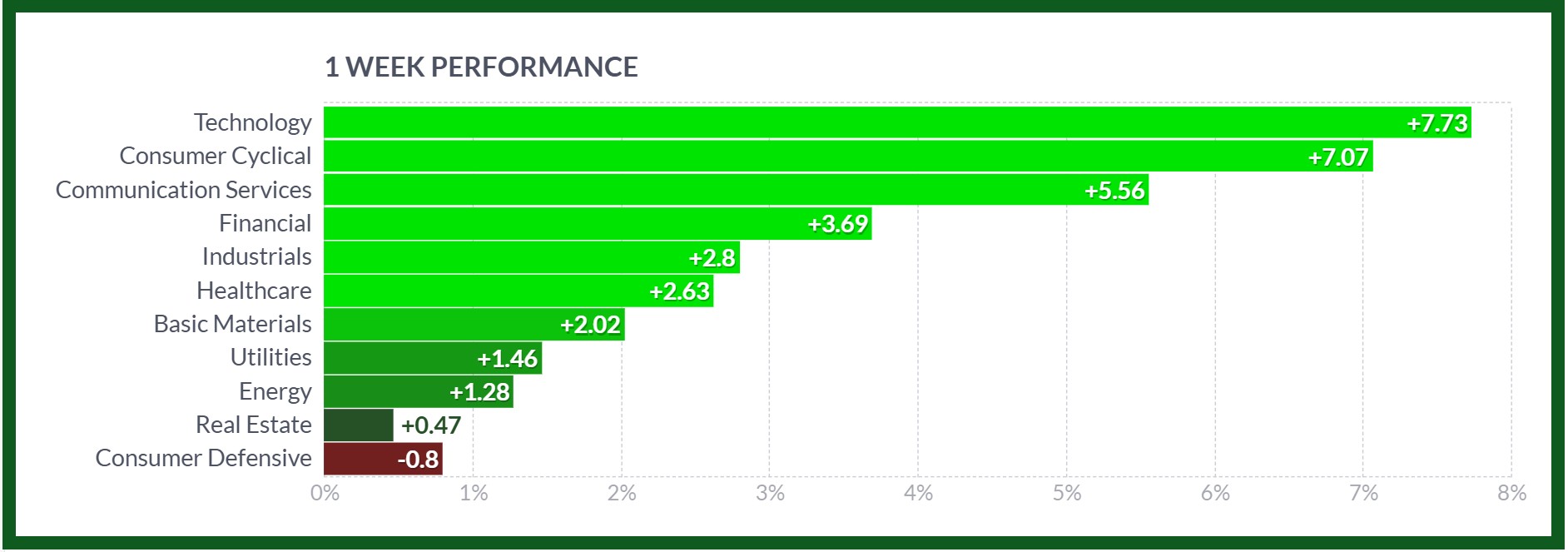

Sector’s Weekly Performance:

Source: Finviz

Last week, nearly all sectors made strong gains:

- Technology jumped 7.7%, driven by ServiceNow‘s 22% weekly rise after strong Q1 profits supported by high demand for AI-powered software. While Intel faced challenges and dropped on Friday due to a poor forecast, it still ended the week up 6%. The Semiconductor Index climbed 11%.

- Consumer Discretionary surged 7%. Tesla advanced 18% as investors welcomed Elon Musk reducing his focus on DOGE, offsetting a revenue miss.

- Communication Services rose 5.5%. Netflix gained confidence from its revenue outlook, and Alphabet’s better-than-expected ad revenue lifted social media stocks.

- Financials were up 3.6%, with Capital One benefiting from a regulatory approval involving Discover. Banking indexes also saw strong weekly growth.

- Industrials increased by 2.8%. Boeing gained on improved jet deliveries, though Northrop Grumman fell sharply after profits dropped.

- Consumer Staples was the only sector to decline, fell 0.8%. PepsiCo cut its profit forecast due to trade war impacts, and Procter & Gamble lowered its 2025 forecast due to weak spending.

Stock Market Weekly Performance:

Source: Finviz

Top Performers

Last week saw remarkable stock market performance, with several companies standing out as top gainers:

- ServiceNow (NOW): Surged 22% due to robust quarterly earnings and strong demand for its AI-powered software solutions.

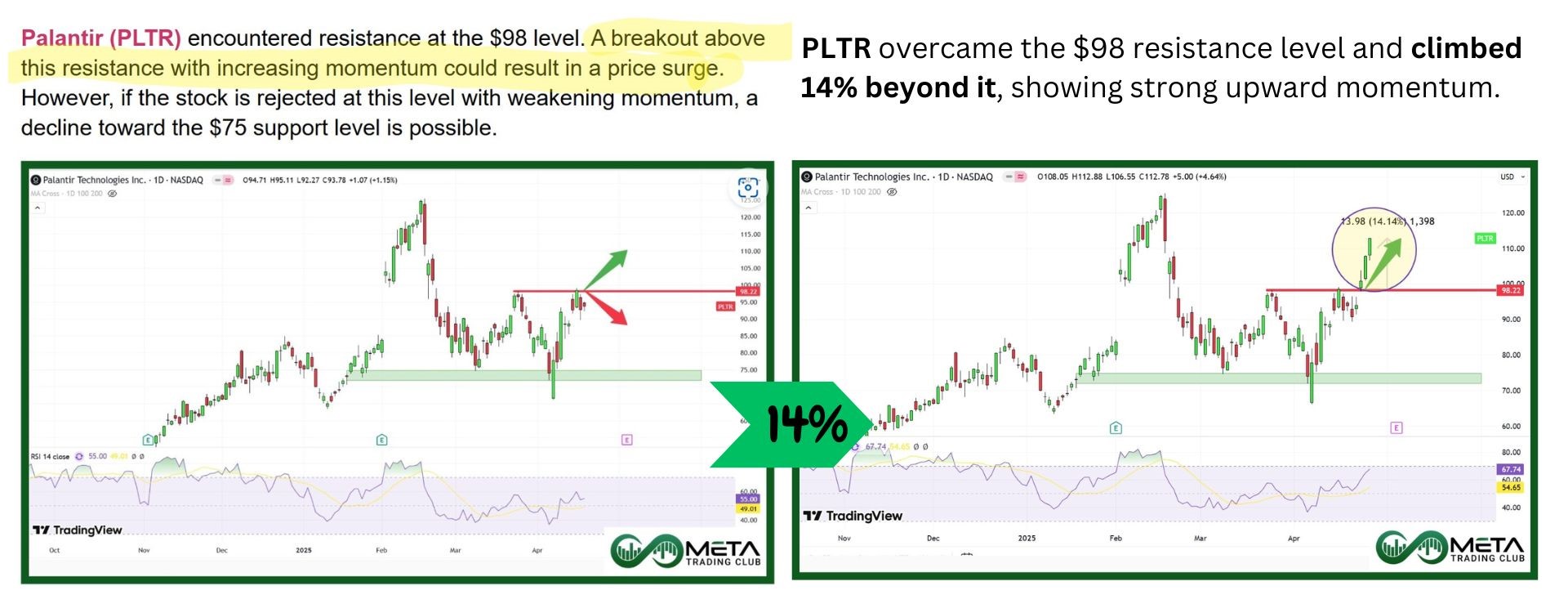

- Palantir Technologies (PLTR): Increased 20% due to new government contracts and advancements in AI technologies.

- Tesla (TSLA): Gained 18% followed Elon Musk’s announcement of refocusing on the company and reducing external commitments. Despite delivery challenges and bad earnings.

- GE Vernova (GEV): Rose 15% as restructuring efforts gained traction, supported by strong performance in renewable energy and favorable analyst outlooks.

- Netflix (NFLX): Climbed 13% benefited from successful content releases and subscriber growth.

- CrowdStrike (CRWD): Up 13% due to increased demand for cybersecurity solutions.

- Arm Holdings (ARM): Increased 12% due to optimistic outlook for its semiconductor technology, especially in AI and IoT sectors.

- Broadcom (AVGO): Gained 12% (due to positive sentiment in the semiconductor industry.

- Advanced Micro Devices (AMD): Up 10% from optimism in semiconductor industry.

Action Points

Meta (META) is set to release its earnings this week. If the stock establishes bullish confirmations and maintains upward momentum, it could gain further following its break of the downtrend line. However, the rise might be preceded by a pullback to retest the line before continuing its climb.

Qualcomm (QCOM) is about to release its earnings and has reached a strong resistance level. If the stock breaks this resistance with significant momentum, further gains could follow. However, a poor earnings report could lead to rejection at this level and a potential drop in stock price.

Apple (AAPL) is scheduled to release its earnings this week, with the stock currently at the upper boundary of a descending channel. If the RSI breaks its downward trend and the stock breaks out of the channel, it leads to further gains. However, if momentum weakens and the stock faces rejection at the channel’s top, a decline could follow.

Commodity

Weekly Performance of Gold, Silver, WTI and Brent Oil:

Source: Finviz

Gold (XAUUSD) dropped after briefly crossing $3,500 per troy ounce earlier in the week, ending 3.3% lower for the week. Its rapid rise suggests it may have already peaked and could need a pause before climbing further. Despite this, strong ETF demand is still supporting gold, says the World Gold Council.

Gold prices fell as the U.S. dollar strengthened and investors showed increased risk appetite, moving towards higher-yielding assets. The shift reflects a preference for equities and other riskier investments, reducing gold’s appeal as a safe-haven asset during this period of market optimism.

Crude oil consolidated last week amid concerns about excess supply and disagreements within OPEC+, including Kazakhstan’s reluctance to meet output targets. Uncertainty around U.S.-China trade relations and a potential U.S.-Iran nuclear deal added to supply worries.

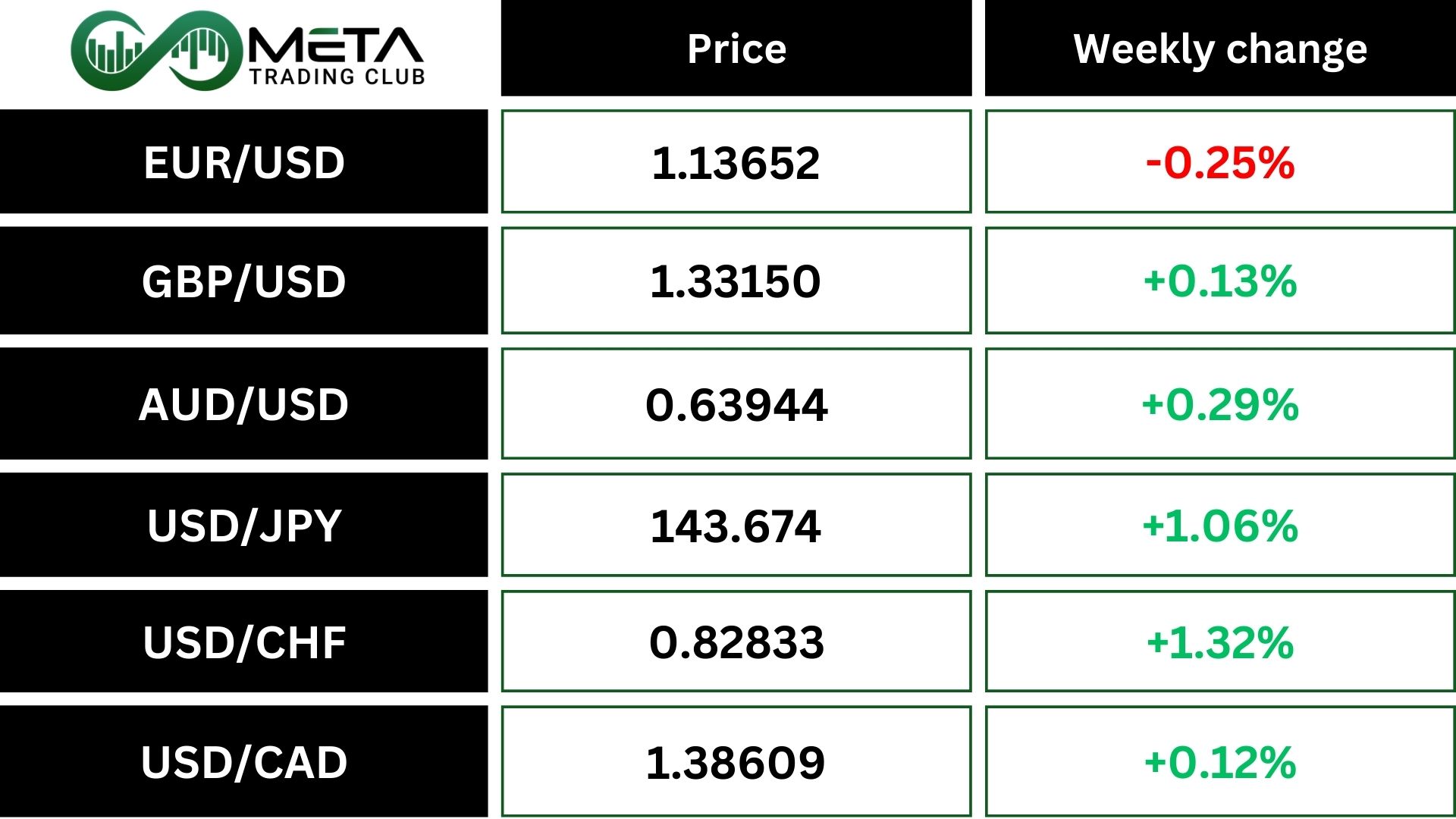

Forex

Weekly Performance of Major Foreign Exchange Pairs:

The dollar rose slightly against a basket of currencies, marking its first weekly gain since mid-March. Progress in U.S. trade talks with South Korea and Japan also supported the dollar.

However, concerns about tariffs and their impact on U.S. growth and global markets remain, with Japan’s Finance Minister denying currency target discussions. The Bank of Japan reiterated its focus on raising interest rates if inflation nears its 2% target, while monitoring U.S. tariff effects.

The EUR/USD falling below $1.13 might lead to further declines, especially if Washington confirms a tariff rollback. However, inconsistent signals from the Trump administration have created uncertainty, leaving investors unsure about the market’s direction.

The British pound has climbed 5% since early April, continuing a strong winning streak. This increase reflects positive market sentiment, driven by factors such as robust UK data, including retail sales, and optimism about economic resilience.

Crypto

Crypto Market Weekly Performance:

Source: QuantifyCrypto

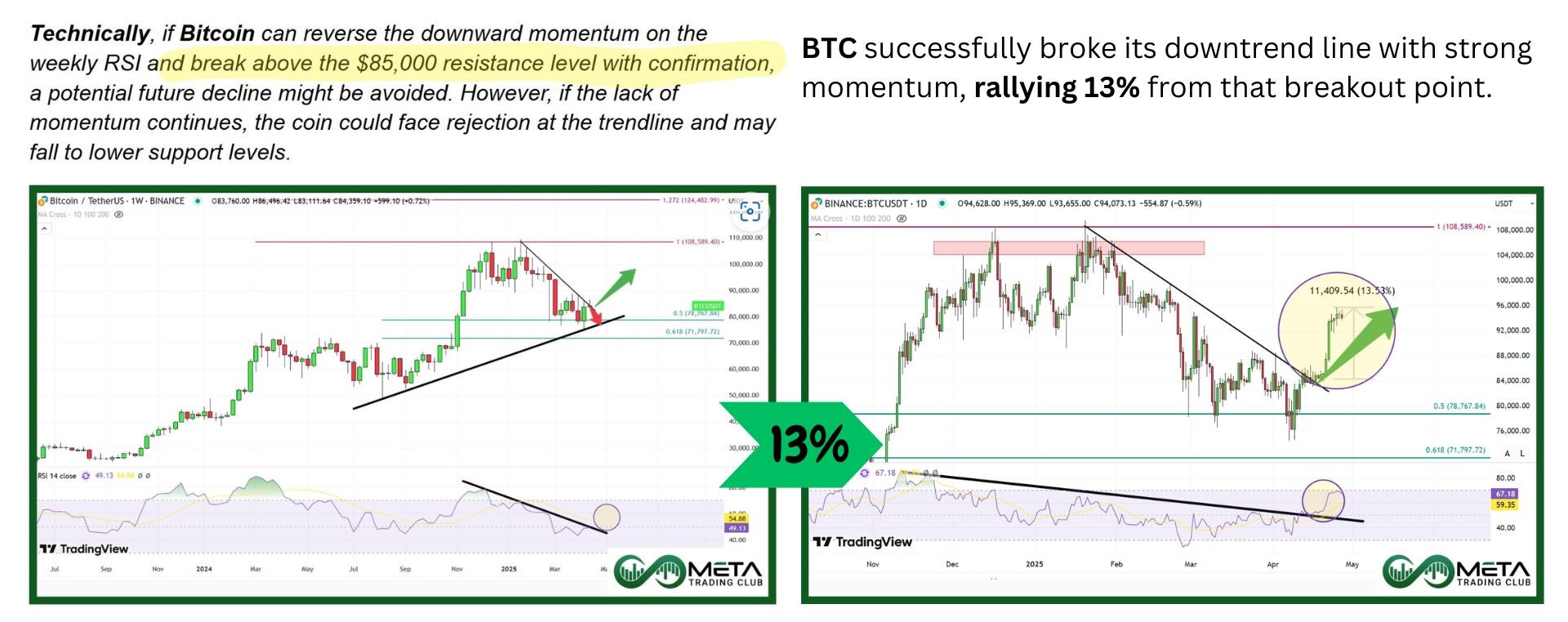

Bitcoin’s price has surged over the past two weeks, sparking speculation about it surpassing $100,000. On-chain data indicates BTC could reach this milestone and set a new all-time high soon.

Bitcoin’s rally last week hit a barrier at $96,000, failing to break through, and has since slipped by about $3,000.

Bitcoin ETFs in the US saw over $3 billion in inflows last week, making it one of their best weeks in 2025. This surge was fueled by Bitcoin’s price recovery and growing interest from institutional investors.

Next Week’s Outlook

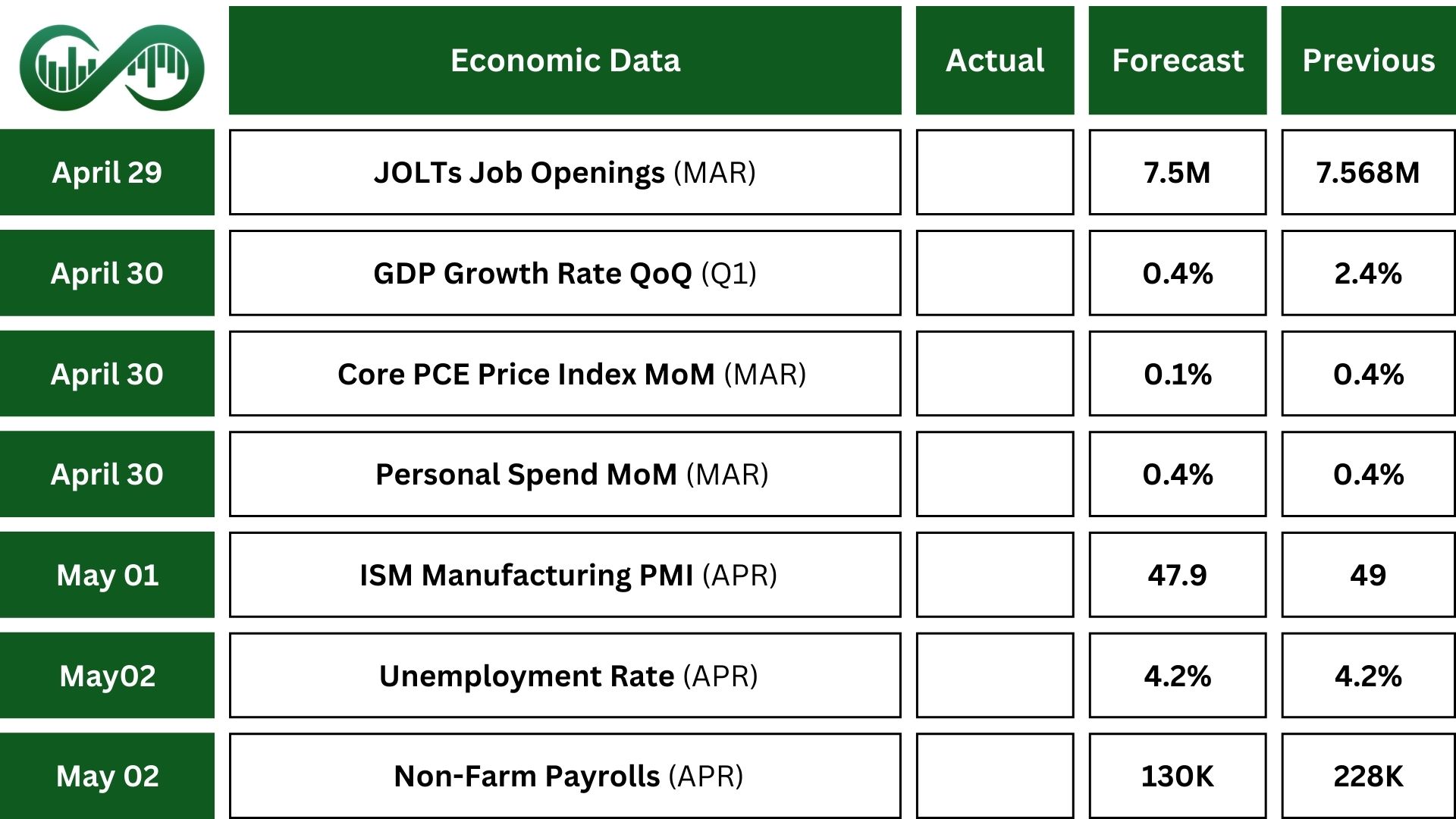

Economic Events

The US GDP is estimated to grow just 0.4% in Q1 2025, the slowest since Q2 2022, down sharply from 2.4% in Q4 2024. This slowdown is mainly due to weaker consumer spending and higher imports ahead of new tariffs.

The April jobs report is also a key focus, as it may reveal the effects of DOGE-related layoffs. The US is expected to have added 130,000 Non-farm Payrolls in April, fewer than in March, with the Unemployment Rate steady at 4.2% and wages growing by 0.3%.

The PCE inflation report may show core inflation falling to 0.1% in March, the lowest in four months, from 0.4%. Personal spending is likely to remain at 0.4%, while income growth could slow to 0.4% from 0.8%.

Other data to watch includes job openings, consumer sentiment, employment figures, housing prices, and factory orders. Additionally, the Treasury plans to release its Q2 refinancing details.

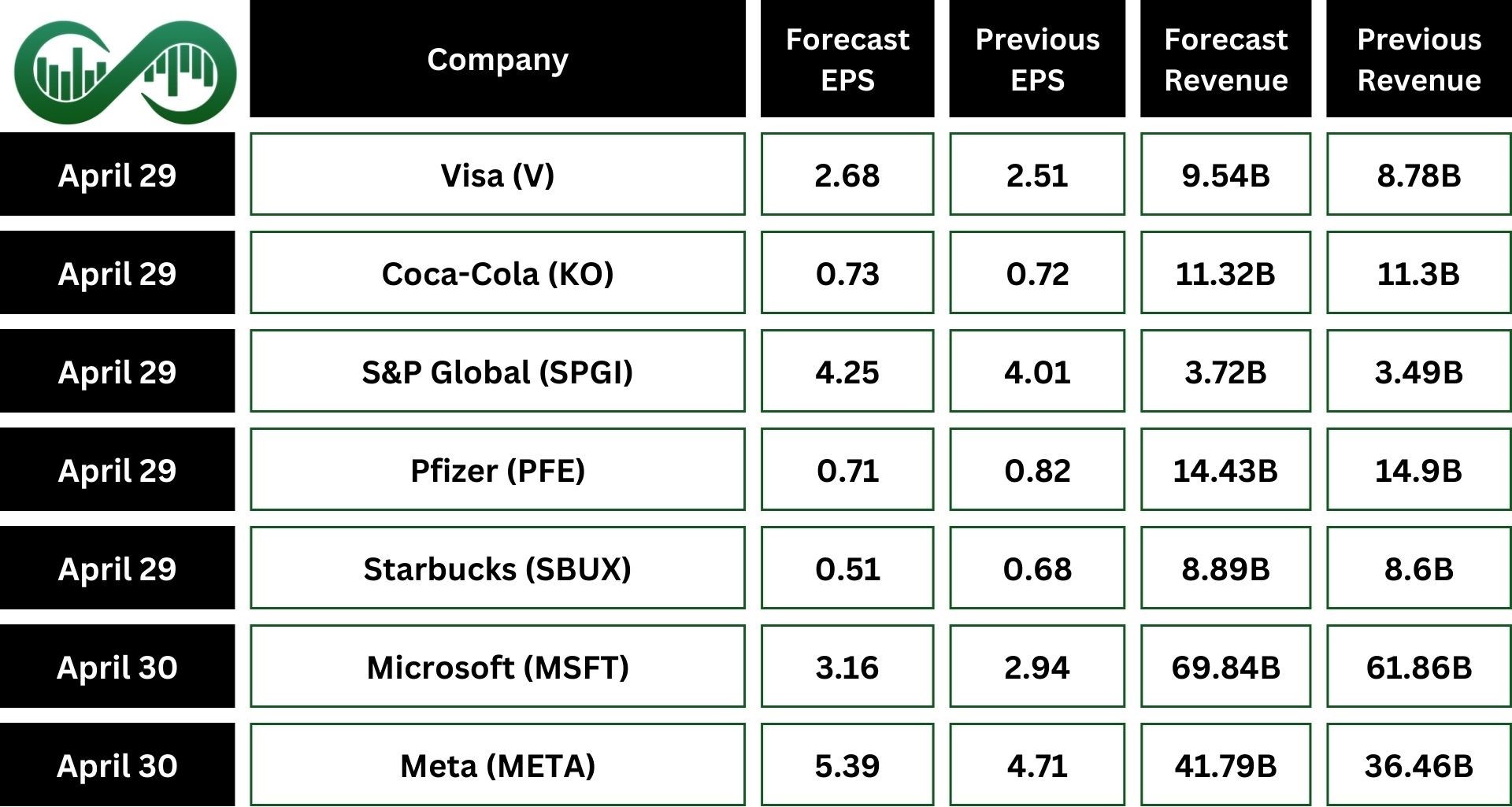

Earnings Events

The corporate earnings calendar is brimming with key reports from industry leaders, including Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Meta (META), Eli Lilly (LLY), Qualcomm (QCOM), Visa (V), Coca-Cola (KO), Honeywell (HON), Mastercard (MA), McDonald (MCD), Exxon Mobil (XOM), and Chevron (CVX). These updates are expected to shed light on their financial performance and market outlooks.

Disclaimer:

The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.