Intel Corporation, founded in 1968 and headquartered in Santa Clara, California, is a global leader in the design and manufacturing of advanced semiconductor technologies. Known for its cutting-edge processors and innovation in computing, Intel has played a pivotal role in driving technological advancements in personal computers, data centers, cloud computing, and AI solutions. With its iconic “Intel Inside” branding, the company has become a household name synonymous with high-performance and reliable technology.

Over the years, Intel has expanded its portfolio beyond microprocessors to include chipsets, graphics, and advanced systems-on-chip solutions. The company is deeply committed to innovation and sustainability.

Intel Fiscal Q1 2025

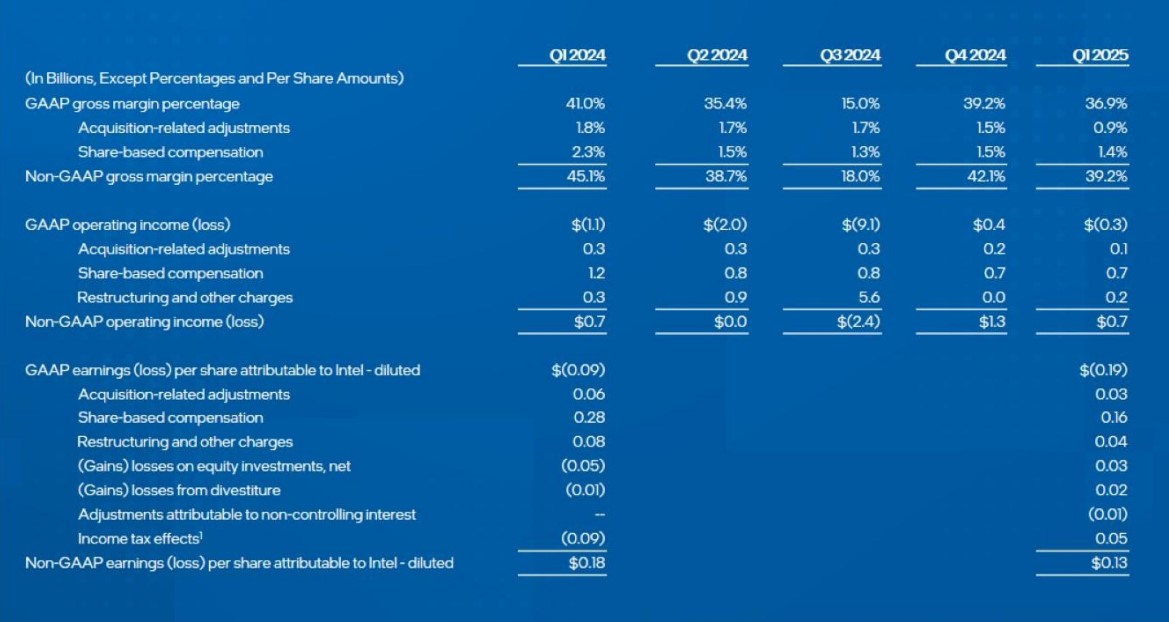

Intel (INTC) released its first-quarter 2025 financial results, reporting revenue of $12.7 billion, which remained unchanged from the same quarter in 2024. The company recorded a loss per share of $(0.19) under GAAP, while its non-GAAP EPS stood at $0.13.

Key Highlights:

- Operational Efficiency: Intel is streamlining its organization by reducing management layers and speeding up decision-making.

- Expense Targets: Intel lowered its non-GAAP operating expense targets to $17 billion for 2025 and $16 billion for 2026. These expenses include R&D and general administrative costs.

- Capital Expenditures: The gross capital expenditures target for 2025 was reduced to $18 billion. However, net capital expenditures are expected to be between $8 billion and $11 billion.

- Restructuring Charges: Intel expects restructuring charges related to these actions but has not yet estimated their impact.

Outlook

Intel’s second-quarter 2025 guidance includes these estimates:

- Revenue: $11.2 billion to $12.4 billion.

- Gross Margin: 34.3% (GAAP) and 36.5% (non-GAAP).

- Earnings Per Share (EPS): $(0.32) (GAAP) and $0.00 (non-GAAP).

Intel also unveiled plans to enhance execution and operational efficiency, forecasting operating expenses of $17 billion for 2025 and $16 billion for 2026.

Boards Statements

Intel CEO Lip-Bu Tan described the first quarter as a step in the right direction, emphasizing the need for steady efforts to regain market share and achieve sustainable growth. Also, he outlined plans to enhance execution and operational efficiency to rebuild Intel with necessary changes.

Intel CFO David Zinsner characterized the start of the year as solid, highlighting successful execution of key priorities. He acknowledged the elevated uncertainty across the industry due to the current macroeconomic environment, which is reflected in Intel’s outlook.

Impact on the Stock Market

Intel’s stock (INTC) declined by more than 7% after releasing its first-quarter 2025 earnings report. The drop was attributed to flat revenue and a GAAP loss per share, as well as cautious projections for the second quarter. These factors raised concerns among investors, contributing to the sharp decrease in stock value.