PepsiCo, Inc. is a global food and beverage leader headquartered in New York. Founded in 1965 through the merger of Pepsi-Cola and Frito-Lay, the company operates in over 200 countries and territories. PepsiCo’s diverse portfolio includes iconic brands like Pepsi, Mountain Dew, Gatorade, Tropicana, Lay’s, and Quaker. It is known for its broad product range, spanning soft drinks, snacks, and nutrition products.

PepsiCo focuses on performance with purpose, aiming for sustainable growth while reducing its environmental footprint. The company has committed to water conservation, sustainable sourcing, and reducing carbon emissions across its supply chain. In addition to its sustainability initiatives, PepsiCo continually innovates in health and wellness, offering more nutritious products to meet evolving consumer preferences.

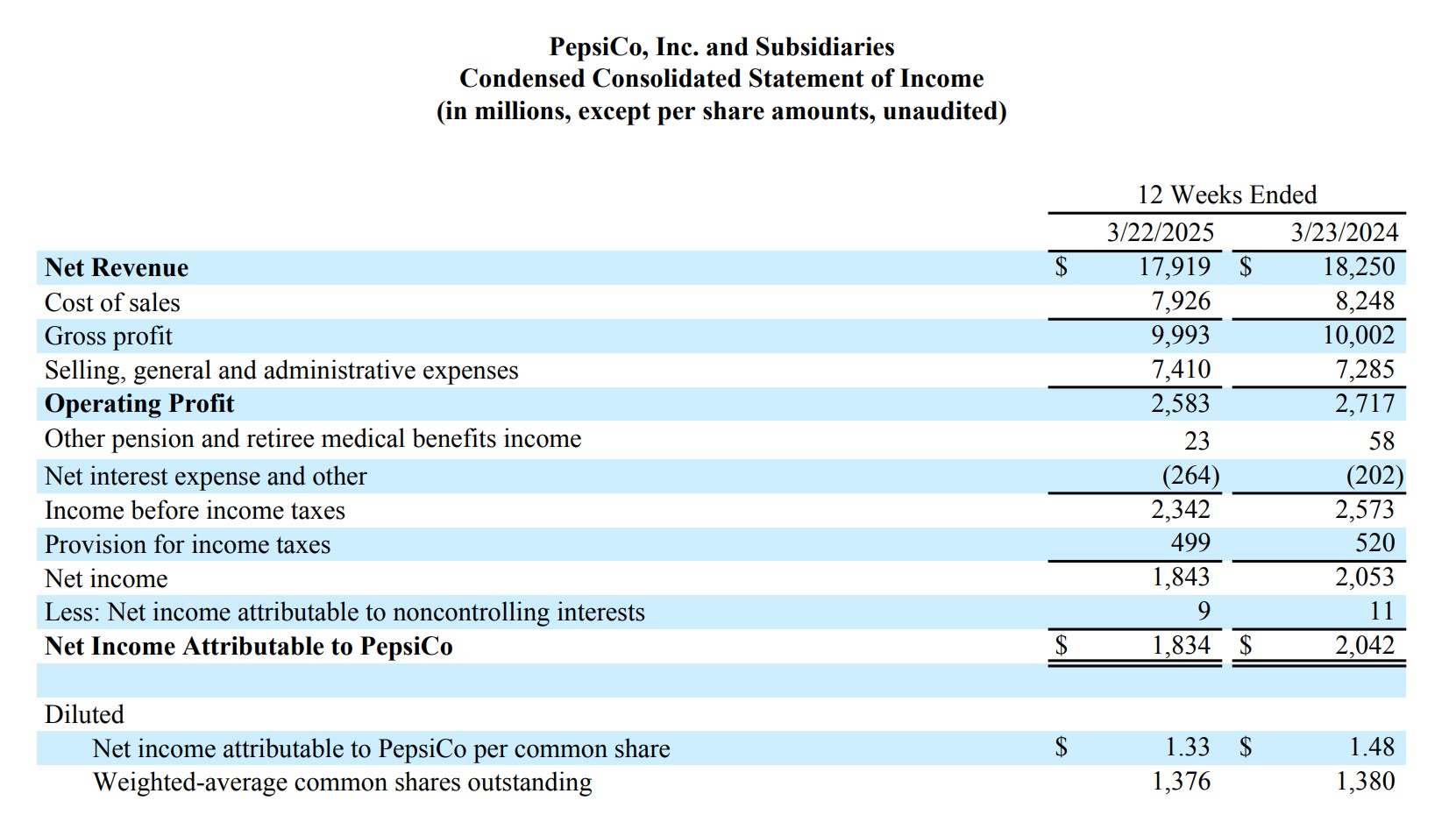

Pepsi Fiscal Q1 2025

PepsiCo (PEP) Q1 2025 earnings reported a profit of $1.83 billion, or $1.33 per share, dropped from a year earlier. Adjusted earnings of $1.48 per share missed analyst expectations by a penny. Revenue dropped 1.8% to $17.92 billion.

The beverages segment performed well, gaining market share with products like Pepsi Zero Sugar and Gatorade. However, snack sales declined as consumers adjusted their shopping habits, though brands like Quaker Foods showed some recovery.

Here are the key points:

- Revenue: Net revenue declined 1.8% YoY to $17.919 billion, missing expectations. Foreign exchange reduced net revenue by 3%.

- Earnings per share (EPS): Released below estimates (10% decrease, with a 4% impact from foreign exchange).

Guidance and Outlook

PepsiCo expects low-single-digit organic revenue growth in 2025, with a core annual tax rate of 20% and $8.6 billion in total cash returns to shareholders, including dividends and share repurchases.

However, due to higher supply chain costs, global economic volatility, and weak consumer demand, core constant currency earnings per share (EPS) are now projected to remain flat compared to last year, instead of showing mid-single-digit growth. Foreign exchange impacts are expected to reduce net revenue and core EPS growth by about 3 percentage points, leading to an estimated 3% decline in core EPS compared to 2024.

Board Statements

PepsiCo’s Chairman and CEO Ramon Laguarta, emphasized the resilience of the company’s operations during the first quarter of 2025, despite increasingly complex geopolitical and macroeconomic conditions. He acknowledged that global trade developments are expected to create more volatility and uncertainty, which will likely lead to higher supply chain costs. Furthermore, consumer conditions in many markets remain weak and unpredictable.

To address these challenges, Laguarta explained that PepsiCo is implementing mitigation strategies to manage higher supply chain costs, while striving to minimize disruption to its operations, consumer and customer relationships, and the long-term health of its business. The company intends to continue expanding its international presence and take measures to improve performance in North America. Its multi-year productivity initiatives will provide funding for strategic commercial investments and support profitability.

Regarding its outlook for 2025, PepsiCo anticipates low-single-digit organic revenue growth. However, the company now projects its core constant currency earnings per share (EPS) to remain approximately flat compared to the prior year, revising its earlier estimate of mid-single-digit growth. Additionally, PepsiCo has announced a 5% increase in its annualized dividend per share, starting with the June 2025 payment, marking its 53rd consecutive year of dividend growth.

Impact on the Market

PepsiCo’s earnings report for the first quarter of 2025 showed mixed results, leading to a drop in its stock price. The company reported adjusted earnings per share (EPS) slightly below the estimates. Also, PepsiCo lowered its full-year EPS growth forecast, expecting flat earnings instead of earlier projections of mid-single-digit growth.

This news caused investor concern about higher supply chain costs, economic uncertainties, and weak consumer spending, which could hurt PepsiCo’s profit. As a result, PepsiCo’s stock fell about 1% in premarket trading.