Boeing is one of the largest and most prominent aerospace companies in the world, renowned for its innovative approach to designing and manufacturing commercial airplanes, defense systems, and space exploration technology. Founded in 1916, the company has its headquarters in Arlington, Virginia, and operates globally with a strong presence across aviation, military, and satellite industries. Boeing is known for its iconic aircraft models such as the 737, 747, and 787, which are widely used by airlines worldwide, showcasing its leadership in the aviation sector.

Beyond commercial aviation, Boeing plays a key role in supporting national defense and advancing space exploration. The company provides cutting-edge military aircraft, satellites, and advanced systems, ensuring its relevance in a competitive global market. With an emphasis on innovation, sustainability, and customer-focused solutions, Boeing continues to drive progress in aerospace technology while maintaining its commitment to safety, quality, and reliability.

Boeing Fiscal Q1 2025

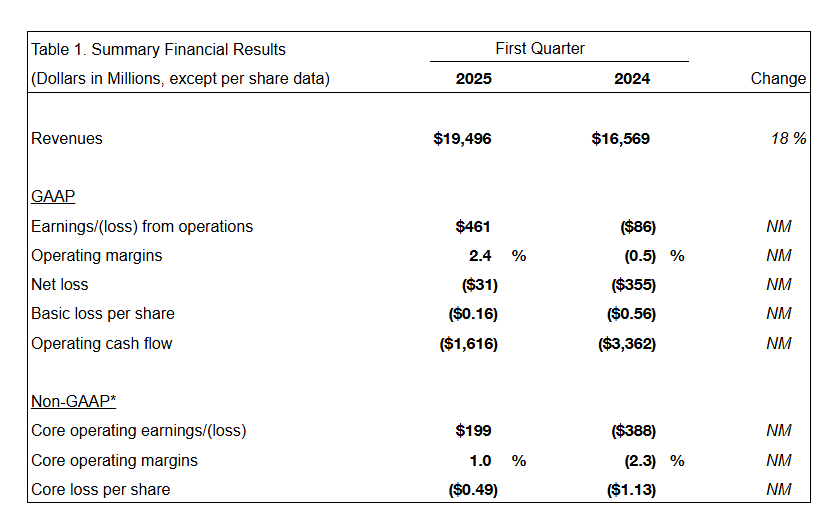

Boeing (BA) reported strong first-quarter performance, with an adjusted operating profit of $199 million on $19.5 billion in revenue. While the revenue beat estimates, the earnings per share (EPS) loss of 49 cents was worse than expectations.

The company is projected to deliver around 580 jets during 2025 as it recovers from prior production setbacks due to labor strikes and quality issues.

Additionally, Boeing’s defense and services segments showed progress, posting profits of $155 million and $943 million, respectively. Despite ongoing concerns over production quality, tariff impacts, and strategic responses to trade challenges, high demand for aircraft persists amid production constraints.

Earning Highlights:

- 737 Production: Production increased gradually during the quarter and is expected to reach 38 planes per month this year.

- Revenue: Raised to $19.5 billion, mainly due to delivering 130 commercial jets.

- Earnings: Reported a GAAP loss per share of ($0.16) and a core (non-GAAP) loss per share of ($0.49).

- Cash Flow: Operating cash flow was ($1.6) billion, and free cash flow (non-GAAP) was ($2.3) billion.

- Backlog: Total backlog grew to $545 billion with orders for more than 5,600 commercial airplanes.

Impact of Earning on Stock

Boeing’s Q1 2025 earnings had a positive impact on its stock (BA). The company reported better-than-expected results, including an adjusted operating profit of $199 million and revenue of $19.5 billion, which exceeded Wall Street estimates.

As a result, Boeing’s stock (BA) rose over 6% following its Q1 2025 earnings report. The strong performance was driven by better-than-expected results. This positive momentum was further supported by optimism around easing U.S.-China trade tensions and improved operational performance, such as increased jet deliveries and a growing backlog.