Tesla is an American electric vehicle and clean energy company based in Palo Alto, California. Founded in 2003 by Martin Eberhard and Marc Tarpenning, Tesla is led by CEO Elon Musk, who joined shortly after. Tesla specializes in electric vehicles, battery energy storage from home to grid scale, solar panels, and solar roof tiles.

The company’s mission is to accelerate the world’s transition to sustainable energy. Tesla’s product lineup includes the Model S, Model 3, Model X, Model Y, Cybertruck, and the Roadster, along with energy products like the Powerwall, Powerpack, and Megapack. The company continues to push the boundaries of technology and innovation, aiming to make renewable energy accessible and sustainable for all.

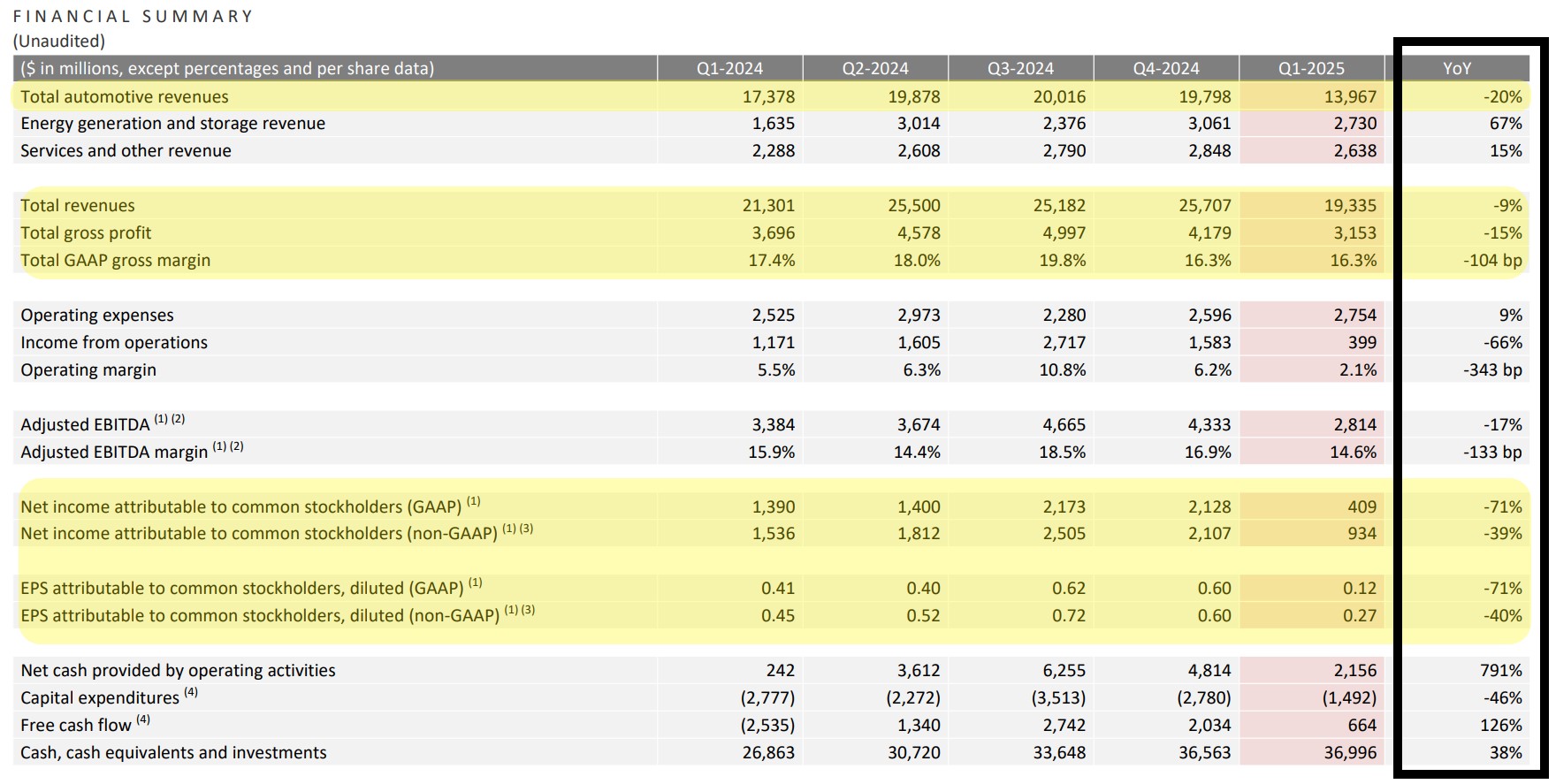

Tesla Fiscal Q1 2025

Tesla (TSLA) reported Q1 2025 results which fell short of expectations. Revenue dropped 9%, missing the predictions. Earnings per share (EPS) came lower than expected. The drop reflects challenges like fewer vehicle deliveries and lower selling prices.

Tesla faced challenges including protests, boycotts, and declining sales in key markets like China and California, partly due to Elon Musk’s political affiliations. The company’s stock has nearly halved since December, and plans for a new low-cost model were scrapped in favor of cheaper variants. Production of an affordable Model Y crossover has been delayed, and driverless ride-hailing services face regulatory hurdles.

Earning Highlights

Revenue: Total revenue dropped by 9% year-over-year (YoY) to $19.3B. The decline was due to fewer vehicle deliveries (partly from Model Y updates), lower average selling prices (ASP) caused by discounts and sales incentives, and a $0.3B negative foreign exchange (FX) impact. On the positive side, revenue grew in energy storage, services, and from higher regulatory credits.

Profitability: Operating income plunged 66% YoY to $0.4B, with a slim 2.1% operating margin. This was due to lower vehicle ASP, fewer deliveries, and higher spending on AI and R&D. However, there were positives: higher profits from energy storage, lower Cybertruck production costs, reduced costs per vehicle (thanks to cheaper raw materials), and higher regulatory credits.

Cash: Cash and investments increased by $0.4B to $37.0B, mainly from $0.7B in positive free cash flow.

Outlook of 2025:

Tesla has decided not to provide an outlook due to challenges in gauging the effects of changing global trade policies on its supply chains, costs, and demand for durable goods. The company plans to keep investing in its vehicle and energy businesses but acknowledges that growth will depend on production ramp-ups and broader economic conditions. Tesla stated it will revisit its 2025 guidance in its Q2 update.

Board Statements

Tesla acknowledged growing uncertainty in the automotive and energy markets, emphasizing that rapidly shifting trade policies are negatively affecting global supply chains and cost structures for both Tesla and its competitors. The company also highlighted that changing political sentiment might significantly influence demand for its products in the short term. This serves as a caution about the challenges Tesla and the industry may face in navigating these evolving dynamics.

Tesla has reassured investors that its plans for producing new affordable vehicles remain on track for the first half of 2025. Additionally, the company confirmed its expectation to begin volume production of Robotaxis in 2026. Alongside this, ongoing Robotaxi testing is addressing key investor concerns raised ahead of the earnings announcement.

Impact on the Stock Market

Missed revenue and EPS expectations, combined with challenges like declining vehicle sales and lower prices, contributed to the negative investor sentiment.

Despite the disappointing Q1 results, Tesla reassured investors that its plans for affordable electric vehicles remain on track for production in the first half of 2025. This announcement reflects the company’s commitment to expanding accessibility while navigating broader challenges.