The Producer Price Index (PPI) measures the average change over time in the prices that domestic producers receive for their goods and services. Also, it’s a key indicator of inflation at the wholesale level, reflecting price changes from the perspective of the seller rather than the consumer.

The Bureau of Labor Statistics (BLS) releases the Producer Price Index (PPI) report monthly, providing crucial insights into the average change over time in the selling prices received by domestic producers for their goods and services. The report is typically released around the 12th of each month at 8:30 AM Eastern Time. It includes data on various industry classifications, commodity classifications, and the Final Demand-Intermediate Demand system. These offer a comprehensive view of price changes across different sectors. This data is essential for economists, policymakers, and businesses to understand inflationary trends and make informed decisions.

November Producer Price Index

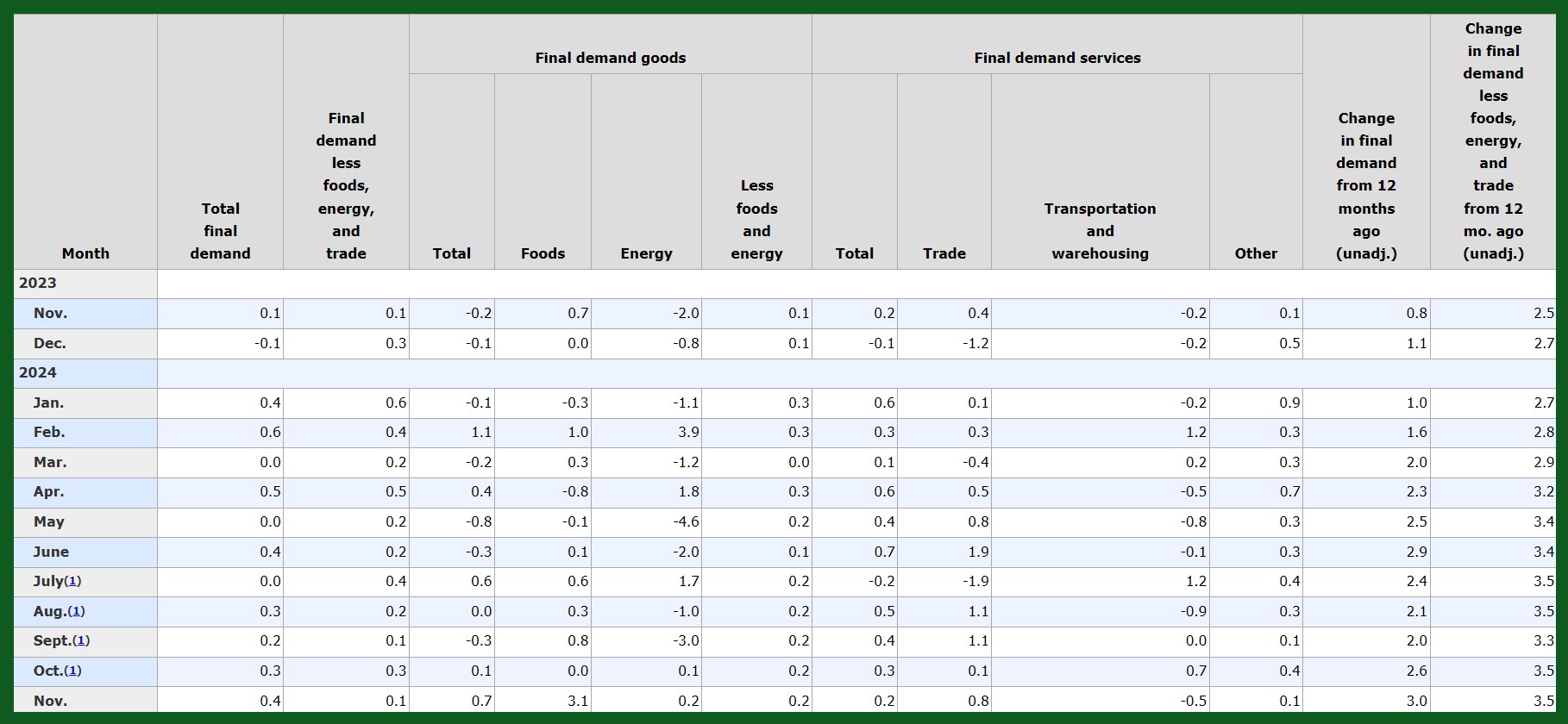

In November 2024, the Producer Price Index (PPI) for final demand in the U.S. rose by 0.4% on a seasonally adjusted basis. This increase follows gains of 0.3% in October and 0.2% in September.

On an unadjusted basis, the PPI advanced by 3.0% over the past 12 months, the largest rise since February 2023.

Most of the increase in November was due to a 0.7% rise in the index for final demand goods, with a notable 54.6% jump in prices for chicken eggs. Final demand services prices also increased by 0.2%.

Excluding foods, energy, and trade services, the PPI inched up by 0.1% in November. Overall, the data reflects rising costs for goods and services at the producer level, with significant contributions from food prices and trade margins.

Over one-third of the rise in prices for final demand services was due to margins for machinery and vehicle wholesaling, which increased by 1.8%.

Image Source: U.S. Bureau of Labor Statistics

Impacts of November PPI Data on Market

Higher PPI (Producer Price Index) readings can indeed raise concerns about the possibility of a rate cut by the U.S. Federal Reserve. When producer prices rise, it often signals increasing inflationary pressures, which might prompt the Federal Reserve to maintain interest rates to keep inflation in check. This can lead to tighter financial conditions and potentially slow down economic growth.

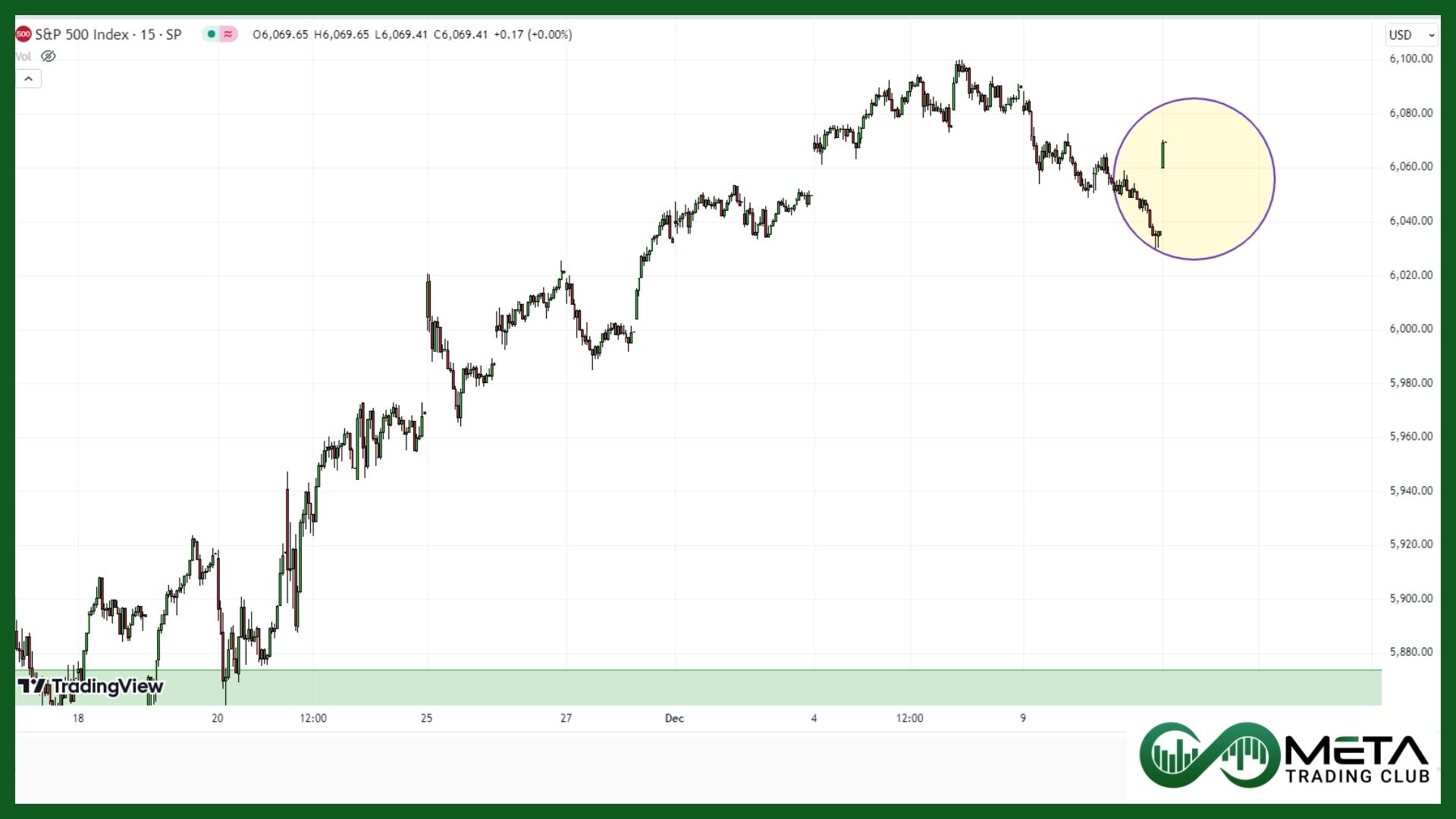

The higher-than-expected PPI increase led to concerns about persistent inflation, causing some volatility in the stock market. The S&P 500 index opened lower by about 0.3% following the release of the PPI data.