The Manufacturing PMI (Purchasing Managers’ Index) is a key economic indicator released by the Institute for Supply Management (ISM). It measures the health of the manufacturing sector by surveying purchasing managers at manufacturing firms across the United States. The PMI is a composite index that considers factors such as new orders, production, employment, supplier deliveries, and inventories.

The PMI is a critical economic indicator composed of several key components that provide insights into the health of the manufacturing sector. These components include new orders, production, employment, supplier deliveries, and inventories. The new orders component measures the level of new orders received by manufacturers, while the production component assesses the rate of production output. Employment evaluates changes in employment levels within the manufacturing sector. Supplier deliveries look at the speed of supplier deliveries and any delays, and inventories monitor changes in inventory levels. Each of these components is surveyed and weighted to calculate the overall PMI. A PMI above 50% indicates expansion in the manufacturing sector, while a reading below 50% indicates contraction.

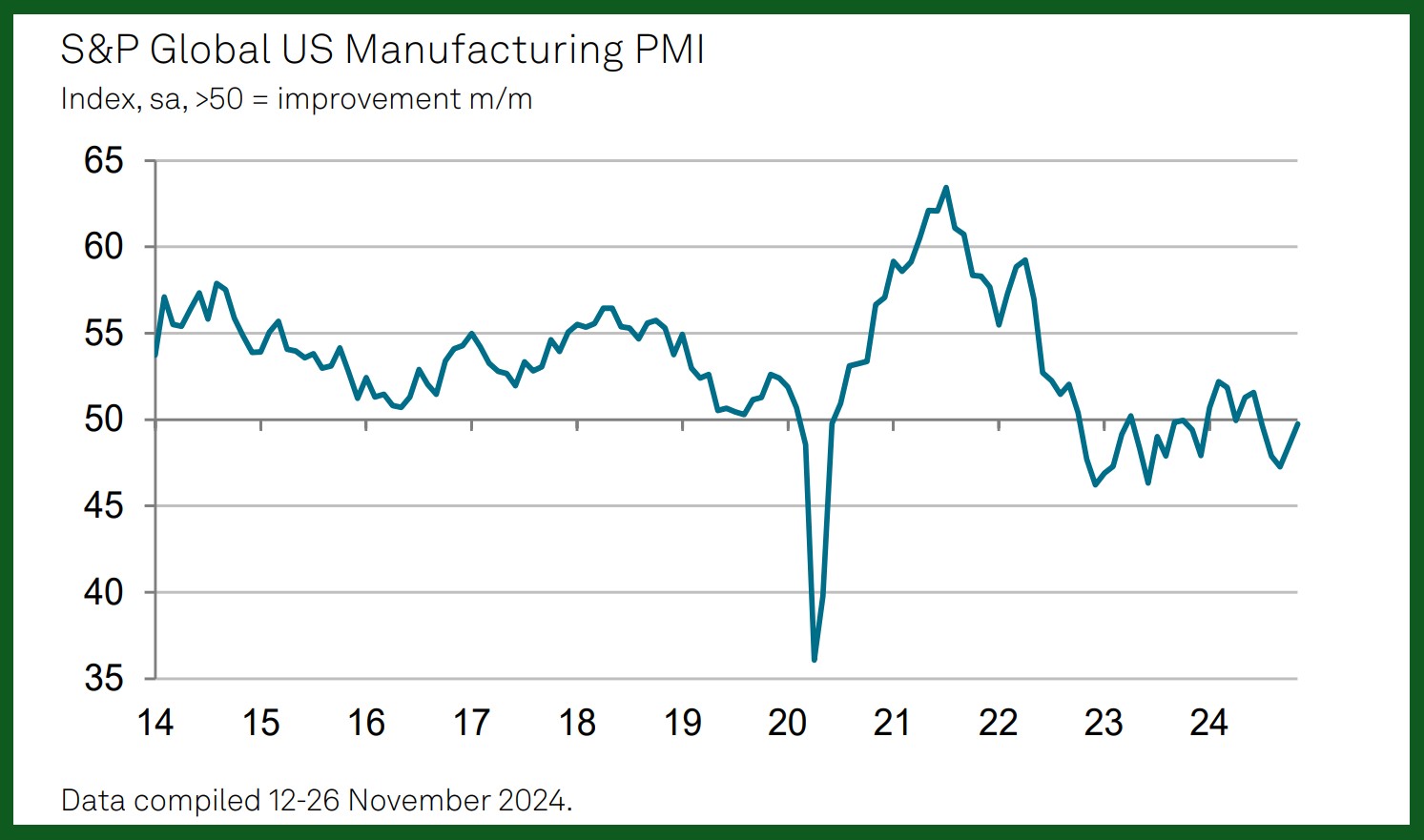

November S&P Global Manufacturing PMI

In November 2024, the US manufacturing sector showed signs of nearing stabilization, with a significant slowdown in the decline of new orders and a rebound in business optimism, which led to renewed job creation.

However, output continued to be reduced due to lingering uncertainties and external factors. Input cost inflation weakened to its slowest pace in a year, while output prices saw a slight increase. The PMI improved to 49.7, indicating a marginal worsening in sector health, but reflecting the highest reading in five months.

Domestic demand improved post-election, though export orders declined sharply. Despite the current production drop, business sentiment for future output reached its highest in over two-and-a-half years, driven by hopes for a strengthened business environment under the incoming administration.

Source: spglobal

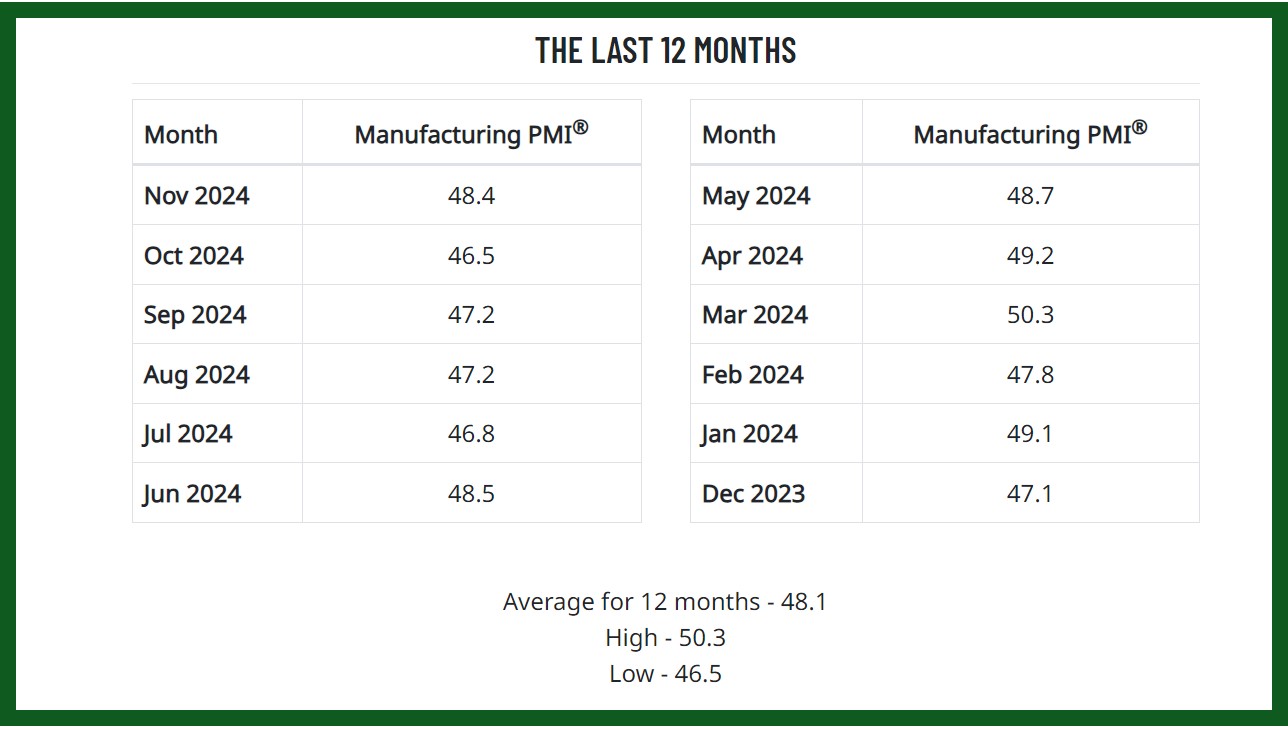

November ISM Manufacturing PMI

The Manufacturing PMI registered at 48.4%, indicating the eighth consecutive month of contraction for the US manufacturing sector, although the decline was slower than in October. New orders grew weakly after seven months of contraction, and business optimism led to renewed job creation. Despite some improvements, production and employment continued to contract, with supplier deliveries speeding up and raw materials inventories contracting. Prices increased, while both exports and imports continued to decline. The overall economy continued to expand for the 55th month, suggesting modest growth.

Key Highlights ISM PMI Report

The US manufacturing sector showed signs of stabilization in November 2024. Here are the key takeaways:

New Orders

The ISM New Orders Index expanded to 50.4 percent, the first growth after seven months of contraction. Despite lingering uncertainty, three of the largest manufacturing sectors reported increased new orders.

Production

The Production Index slightly improved to 46.8 percent but remained in contraction. Manufacturers reduced output due to marginally expanding new orders and declining backlog levels.

Employment

The Employment Index rose to 48.1 percent, still in contraction for the sixth consecutive month. Only the Food, Beverage & Tobacco Products sector expanded employment.

Supplier Deliveries

Supplier deliveries sped up, with the index at 48.7 percent, marking a shift to faster deliveries after four months of slower ones.

Inventories

The Inventories Index increased to 48.1 percent, reflecting a slower rate of contraction. Companies and customers managed working capital closely, with only one major sector reporting increased inventories.

Prices

The Prices Index dropped to 50.3 percent, indicating continued but slower raw materials price increases. Aluminum, copper, and natural gas saw slight increases, while steel, plastic resins, and crude oil prices decreased.