The Kroger Company, founded in 1883 by Bernard Kroger in Cincinnati, Ohio, is one of the largest retail companies in the United States. With over 2,700 grocery retail stores operating under various banners, Kroger serves millions of customers across 35 states and the District of Columbia.

The company’s diverse operations include supermarkets, multi-department stores, fuel centers, pharmacies, and in-store medical clinics. Kroger is also known for its commitment to sustainability and community support through initiatives like the Zero Hunger | Zero Waste Foundation, which aims to eliminate hunger and reduce waste in the communities it serves.

Kroger’s business model emphasizes innovation and inclusivity. The company operates 33 manufacturing plants and supports a wide range of products, from groceries to jewelry. Kroger is also a significant employer, with approximately 414,000 employees, many of whom are represented by collective bargaining agreements. The company is frequently recognized for its efforts in diversity, equity, and inclusion, and it continues to make strides in environmental, social, and governance (ESG) practices. With a strong focus on customer satisfaction and community engagement, Kroger remains a leader in the retail industry.

Kroger Fiscal Q2 2024

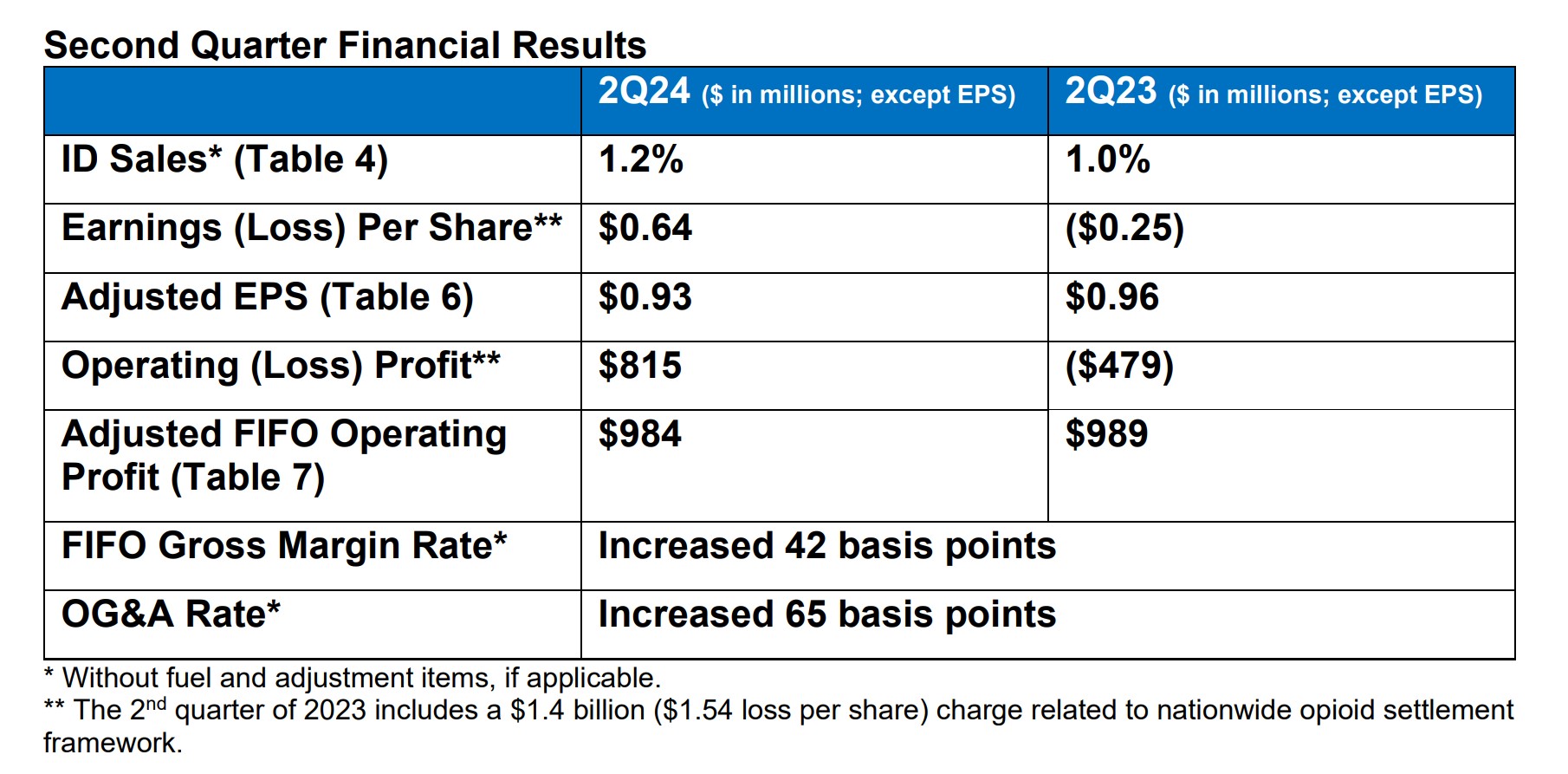

Kroger (KR) has released its second quarter 2024 earnings report today. Here are second quarter highlights:

- Identical Sales (without fuel) increased 1.2%

- Operating Profit of $815 million; Earning Per Share of $0.64

- Adjusted Operating Profit of $984 million and Adjusted EPS of $0.93

- Achieved strong Adjusted Free Cash Flow

- Executed its go-to-market strategy to deliver value for customers

- Grew digital sales 11%

- Increased total households, customer visits and loyal households

Also, in the second quarter of 2024, Kroger reported a revenue of $33.9 billion, matching the same period last year. The revenue missed the estimates. Excluding fuel, sales saw a 1.3% increase. Meanwhile, Kroger posted an operating profit of $815 million, a notable turnaround from a loss of $479 million in the second quarter of 2023. Earnings per share (EPS) were $0.64, compared to a loss of $0.25 per share in the previous year. Adjusted EPS was $0.93, slightly down from $0.96 in the second quarter of 2023.

Source: Kroger

Full-Year 2024 Outlook:

- Adjusted Operating Profit of $4.6 – $4.8 billion

- Adjusted net earnings per diluted share of $4.30 – $4.50

- Adjusted Free Cash Flow of $2.5 – $2.7 billion

- Adjusted effective tax rate of 23%

- Identical Sales without fuel of 0.75% – 1.75%

- Capital expenditures of $3.6 – $3.8 billion

Kroger’s Board Statement

Comments from Chairman and CEO Rodney McMullen:

Kroger’s second-quarter results were strong, demonstrating the resilience of their business model.

Also, Kroger is growing their customer base and increasing visits by offering affordable prices and personalized promotions on high-quality products. The dedication of us associates enhances the customer experience. Kroger’s long-term strategy focuses on lowering prices to attract more customers, which boosts alternative profit businesses and drives efficiencies. This approach allows Kroger to deliver exceptional value to customers, invest in associates, and generate sustainable returns for shareholders.

Comments from Chairman and CEO Rodney McMullen on the pending merger with Albertsons:

“As we near the close of the FTC’s preliminary injunction hearing, we are confident in their position. They believe the food industry will remain competitive post-merger with Albertsons. The merger is expected to bring significant benefits, including lower prices, secure jobs, and better access to fresh, affordable food for customers, associates, and communities nationwide.”

Comments from Interim CFO Todd Foley:

“Our solid sales results through the first two quarters of the year give us the confidence to raise the low end of our full-year identical sales without fuel guidance by 50 basis points. We now expect identical sales without fuel to be in the range of 0.75% to 1.75%.

Our positive customer trends are driving sales momentum that we expect to continue in the second half of the year.”

Impact of Earning on Stock

Kroger Co.’s stock jumped 7% Thursday, after the grocery chain beat profit estimates for the second quarter and raised the low end of full-year same-store sales guidance, offsetting quarterly sales that fell slightly short of estimates.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.