Oracle Corporation is an American multinational computer technology company headquartered in Austin, Texas, Founded in 1977. Oracle has grown to become one of the largest software companies in the world. The company specializes in developing and marketing database software and technology, cloud-engineered systems, and enterprise software.

Also, Oracle Cloud is a comprehensive cloud computing service offered by Oracle Corporation. It provides a wide range of services including servers, storage, networking, applications, and more through a global network of Oracle-managed data centers. Moreover, Oracle serves over 400,000 customers across 145 countries.

As of September 2024, Oracle Corporation has a market capitalization of approximately $390.81 billion. The company’s stock is currently trading around $1 per share and has shown significant growth, with its market cap increasing by over 22% in the past year.

Oracle Fiscal Q1 2025

Oracle Corporation (NYSE: ORCL) yesterday announced fiscal 2025 Q1 results.

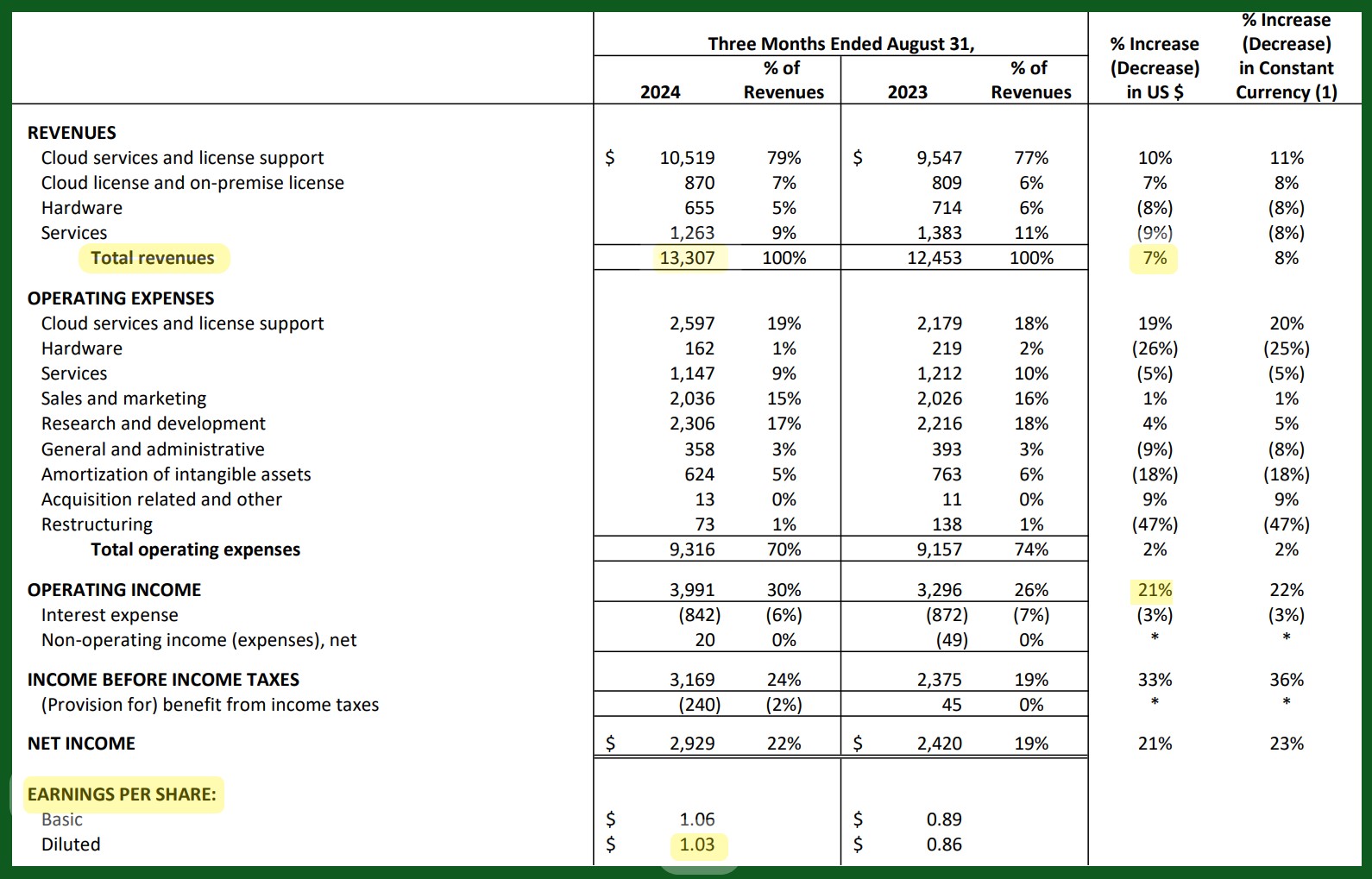

- Total quarterly revenues were up 7% year-over-year to $13.3 billion.

- Cloud services revenues were up 21% year-over-year to $5.6 billion.

- Cloud license and on-premise license revenues were up 7% to $870 million.

- GAAP operating income was $4.0 billion.

- GAAP operating margin was 30% up.

- GAAP net income was $2.9 billion.

- Q1 GAAP earnings per share was $1.03, up 20% while non-GAAP earnings per share was $1.39, which beat the estimate of $1.32.

Short-term deferred revenues were $11.5 billion. Over the last twelve months, operating cash flow was $19.1 billion and free cash flow was $11.3 billion.

image and data source: Oracle.com

Oracle’s fiscal second-quarter outlook calls for 8% to 10% revenue growth. The company is also looking for 24% to 26% growth in cloud.

The company models $1.45 to $1.49 in adjusted earnings per share for the ongoing quarter, while analysts were projecting $1.48.

Oracle’s Board Statement

Oracle CEO, Safra Catz said: “As Cloud Services became Oracle’s largest business, both our operating income and earnings per share growth accelerated. That strong contract backlog will increase revenue growth throughout FY25.”

Also, she added: “the biggest news of all was signing a MultiCloud agreement with AWS (Their latest technology Exadata hardware and Version 23ai of their database software) embedded into Amazon Web Service (AWS) cloud datacenters. AWS customers will get easy and convenient access to the Oracle database when we go live in December later this year.”

Oracle Chairman and CTO, Larry Ellison said: Their largest of these data centers is 800 megawatts and will contain acres of NVIDIA GPU Clusters for training large scale AI models.

Also, he added: In Q1, 42 additional cloud GPU contracts were signed for a total of $3 billion. Their database business growth rate is increasing as a result of our MultiCloud agreements with Microsoft and Google.

Oracle’s recently signed Amazon Web Service (AWS) contract was a milestone in the MultiCloud Era. Soon customers will be able use the latest Oracle database technology from within every Hyperscale’s cloud.

The board of directors declared a quarterly cash dividend of $0.40 per share of outstanding common stock. This dividend will be paid to stockholders of record as of the close of business on October 10, 2024, with a payment date of October 24, 2024.

Impact of Earning on Stocks

Shares of Oracle Corporation rose sharply in today’s pre-market trading after the company reported better-than-expected earnings and sales results for its first quarter on Monday.

Oracle stocks price gap up and jumped 10% to $154.23 in the pre-market trading.

As you can see, the price gap up above the current resistance and all time high $146. Also, Oracle is in a bullish trend which can lead the price till $167 which is a Fibonacci extension resistance.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.