Trade execution is the process of completing a buy or sell order in the financial markets. It involves various order types, such as market orders, limit orders, stop orders, and stop-limit orders, each serving different purposes and strategies. Understanding these order types is crucial for effective trading, as they help traders control the price, timing, and conditions under which their trades are executed. To discover more about trade execution and order types, stay with us in this article.

Table of Contents

What Is Trade Execution?

Trade execution is the process of completing a buy or sell order for a security in the financial markets. It involves several key steps from the moment a trader places an order to the point where the transaction is finalized. Also, Trade execution refers to the series of actions taken to fulfill a trader’s order to buy or sell a security. In addition, this process includes order placement, routing, matching, and finalizing the transaction, ensuring the transfer of ownership and funds between the buyer and seller.

How Does Trade Execution Work?

Quick and proper execution ensures you get the best possible price, also minimizes errors and discrepancies. So, understanding execution helps manage costs related to trading, such as fees and slippage. Let’s discover how orders are executed:

- Order Placement

You decide to buy or sell a security and place an order through your broker or trading platform. In order to do that, you can choose from various order types like market, limit, stop, or stop-limit orders, depending on your strategy and objectives. - Order Routing

The broker receives your order and determines the best route for execution. This could involve sending the order to a stock exchange, a market maker, or an Electronic Communications Network (ECN). The broker considers factors like price, speed, and liquidity to ensure the best execution. - Order Matching

Your order is matched with a corresponding buy or sell order in the market. For example, if you place a buy order, it will be matched with a seller willing to sell at your specified price. Moreover, the order book, which lists all buy and sell orders, plays a crucial role in this process. Orders are matched based on price and time priority. - Trade Execution

Once a transaction is matched, the trade is executed. This means the ownership of the security is transferred from the seller to the buyer. However, the price at which the trade is executed may vary slightly from the order price due to market fluctuations, especially for market orders. - Trade Confirmation

After execution, you receive a confirmation from your broker detailing the trade, including the number of shares, execution price, and any fees or commissions. Finally, the trade then goes through a settlement process, typically taking two business days (T+2) for stocks, where the actual transfer of securities and funds occurs.

Example:

If you place an order to buy 100 shares of a stock, the broker will route your order to the appropriate market where it will be matched with a seller. Once the trade is executed, you will receive a confirmation that you now own 100 shares of the stock.

Imagine you want to buy 100 shares of a company trading at $50 per share:

- Order Placement: You place a market order to buy 100 shares.

- Order Routing: Your broker routes the order to the stock exchange.

- Order Matching: The order is matched with a seller offering 100 shares at $50.

- Trade Execution: The trade is executed at $50 per share.

- Trade Confirmation: You receive a confirmation that you now own 100 shares, and the funds are deducted from your account.

Methods of Trade Execution

Trade execution can be carried out through various methods, each with its own advantages and considerations. Here are the primary methods of trade execution:

- Market Maker:

A market maker is a firm that buys and sells securities from its own inventory. Brokers may route orders to market makers, who provide liquidity by being ready to buy or sell at publicly quoted prices. Market makers earn profits from the bid-ask spread. - Over the Counter (OTC) Market Maker:

In the OTC market, trades are executed directly between two parties without going through a centralized exchange. OTC market makers facilitate these trades, often for securities not listed on major exchanges. This method is common for bonds, derivatives, and some stocks. - Electronic Communications Network (ECN):

An ECN is an automated system that matches buy and sell orders for securities. ECNs allow traders to trade directly with each other, bypassing market makers. They are known for providing transparency and often lower trading costs. - Internalization:

Internalization occurs when a broker fills a client’s order from its own inventory of securities. This method can provide faster execution and potentially better prices, as the broker avoids sending the order to an external market. - Direct Market Access (DMA):

DMA allows traders to place orders directly on the exchange order book, bypassing brokers. This method provides greater control over the execution process and is used by institutional and high-frequency traders. - Algorithmic Trading:

Algorithmic trading uses computer algorithms to automatically execute trades. This can optimize execution by considering factors like price, timing, and volume, and is widely used in high-frequency trading. - Dark Pools:

Dark pools are private trading venues where large orders can be executed without revealing the order size to the public. This method helps prevent market impact and allows institutional traders to trade large blocks of securities discreetly.

Example

Imagine you want to buy 1,000 shares of a stock:

Market Maker: Your broker could route the order to a market maker who sells you the shares from their inventory.

ECN: Your order could be matched with a seller’s order on an ECN, and the trade is executed automatically.

Internalization: Your broker could fill the order from their own inventory, providing immediate execution.

Ask and Bid Price

The bid and ask prices are fundamental concepts in trading, representing the highest price a buyer is willing to pay for a security (bid) and the lowest price a seller is willing to accept (ask). Let’s explore these in detail:

Bid Price

The bid price is the highest price that a buyer is willing to pay for a security. It reflects the demand for security. When you place a bid, you are essentially offering to buy the security at that price.

For example, if the bid price for a stock is $99, it means buyers are willing to pay up to $99 for that stock.

Ask Price

The ask price (or offer price) is the lowest price that a seller is willing to accept for a security. It reflects the supply of security. When you place an ask, you are offering to sell the security at that price.

For example, if the ask price for a stock is $101, it means sellers are willing to sell the stock for at least $101.

Spread

The bid-ask spread is the difference between the bid and ask prices. It is a key indicator of the liquidity of the asset. A smaller spread typically indicates higher liquidity, meaning the security can be bought or sold quickly without significantly affecting its price.

Imagine you want to buy shares of a company:

Suppose the bid price is $99 and the ask price is $101, the bid-ask spread is $2.

- Bid Price: You see the highest bid price is $99.

- Ask Price: The lowest ask price is $101.

If you want to buy immediately, you will pay the ask price of $101. Also, if you want to buy at a lower price, you might place a bid at $99 and wait for a seller to accept it.

Want to boost your trading skills, participate in our incubator program.

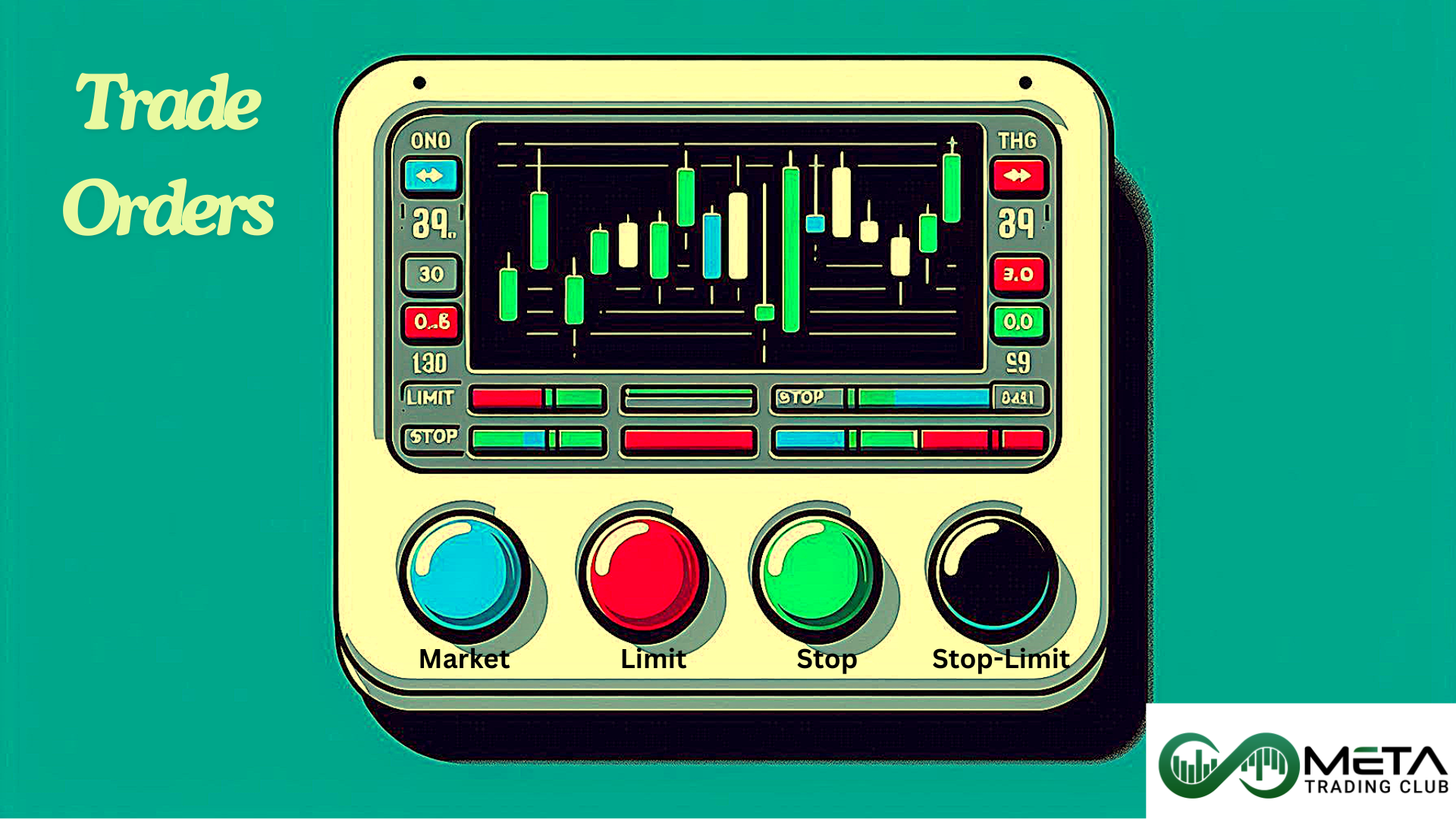

What Is a Trade Order?

A trade order is an instruction given by a trader or investor to a broker or trading platform to buy or sell a security, such as stocks, bonds, or derivatives. Also, there are several types of trade orders, each serving different purposes and strategies. So, understanding these different types of orders can help you manage your trades more effectively and align them with your trading goals.

Market Order

A market order is an instruction to buy or sell a security immediately at the best available current price. Also, this type of order guarantees execution but not the price. It’s typically used when the priority is to execute the trade quickly rather than at a specific price.

Moreover, Market orders are executed almost instantly, making them ideal for situations where the speed of execution is more important than the price. Also, they are typically used when you want to enter or exit a position quickly.

While market orders guarantee execution, they do not guarantee the execution price. The final price is determined by the current market conditions at the time the order is placed. However, in fast-moving or less liquid markets, the execution price can differ significantly from the last traded price.

Furthermore, market orders are straightforward and easy to place, making them a common choice for many traders, especially those trading highly liquid securities like large-cap stocks or popular ETFs.

Example

If you place a market order to buy 100 shares of a stock currently trading at $50.

You place a market order to buy 100 shares. Then the order is executed immediately at the best available prices, which might be slightly higher or lower than $50 due to market fluctuations.

When to Use Market Orders?

- Liquidity: When trading highly liquid securities where the bid-ask spread is narrow.

- Instancy: When you need to execute a trade quickly, such as reacting to breaking news or market events.

- Simplicity: When you prefer a simple and straightforward order type without the need to specify a price.

Pros and Cons

Pros

Guaranteed execution.

Fast and straightforward.

Cons

No control over the execution price.

Potential for slippage in volatile or less liquid markets.

Limit Order

A limit order is an instruction to buy or sell a security at a specific price or better. Also, limit order sets a specific price at which you are willing to buy or sell a security. However, the order will only be executed if the market price reaches your specified limit price or better. Meanwhile, the type of order gives traders control over the price at which their trade is executed, but it does not guarantee that the order will be filled.

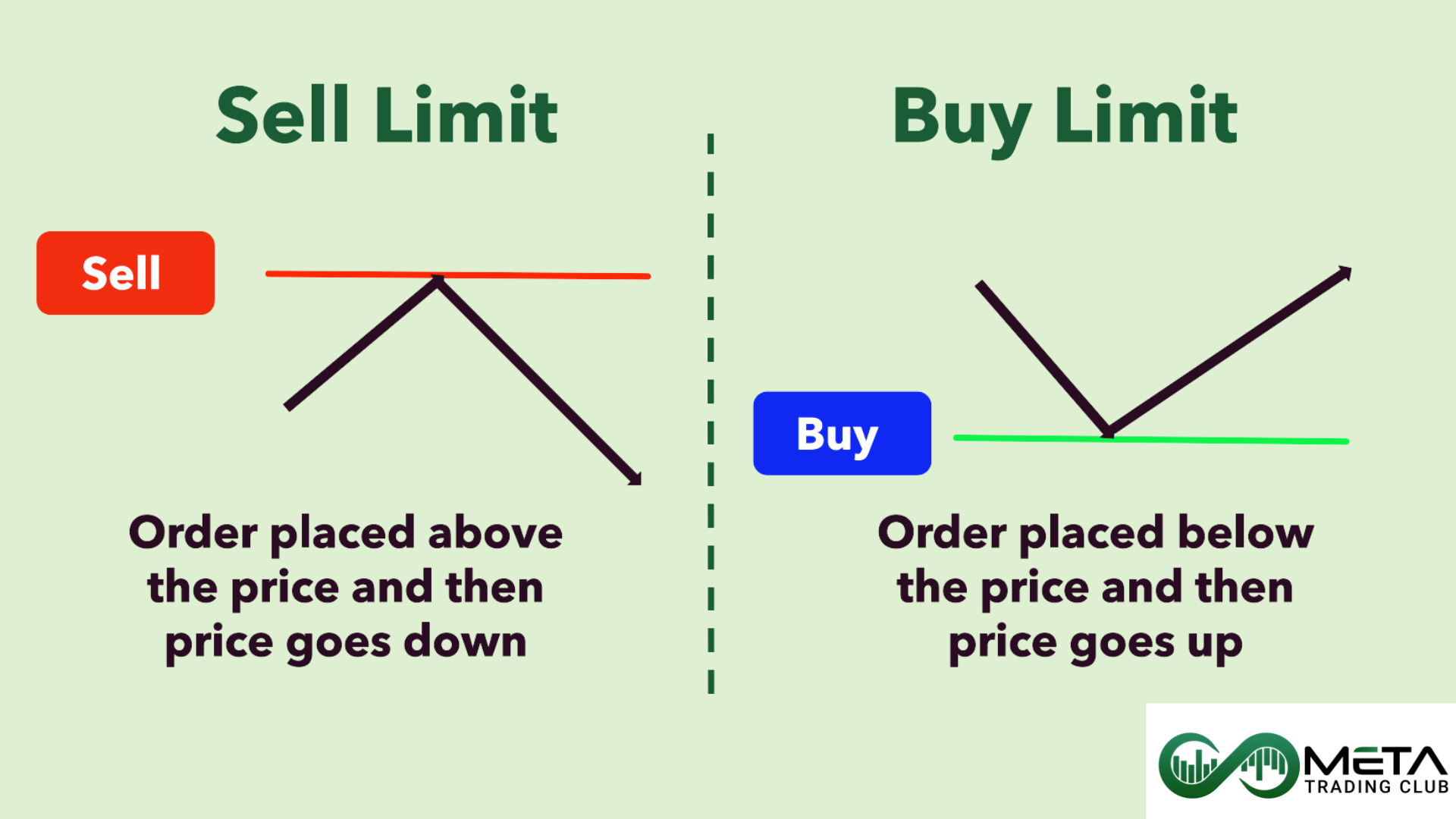

There are two types of limit orders:

Buy Limit Order

This is an order to buy a security at a specified price or lower.

For example, if you place a buy limit order for a stock at $50, the order will only be executed if the stock price drops to $50 or below.

Sell Limit Order

This is an order to sell a security at a specified price or higher.

For example, if you place a sell limit order for a stock at $60, the order will only be executed if the stock price rises to $60 or above.

Example

Imagine you want to buy 100 shares of a stock currently trading at $55, but believe the current price is too high and the price might drop:

You place a buy limit order at $50, ensuring they only purchase the shares if the price drops to desired level $50. The order will only be executed if the stock price falls to $50 or lower.

If the stock price drops to $50, your order is filled at $50 or better. However, if the price does not drop to $50, the order remains unfilled.

When to Use Limit Orders?

- Entering a Position: When you want to buy a security at a specific price lower than the current market price.

- Exiting a Position: When you want to sell a security at a specific price higher than the current market price.

- Volatile Markets: When market prices are fluctuating rapidly, and you want to ensure you get a specific price.

Pros and Cons

Pros

- Price Control: You can specify the exact price at which you want to buy or sell, ensuring you do not pay more or sell for less than your desired price.

- Risk Management: Limit orders can help manage risk by setting predefined entry and exit points.

- Strategic Flexibility: Useful in volatile markets where prices can change rapidly, allowing you to set your desired price without constantly monitoring the market.

Cons

- No Guarantee of Execution: If the market price does not reach your limit price, the order will not be executed.

- Missed Opportunities: In fast-moving markets, the price may move away from your limit price, resulting in missed trading opportunities.

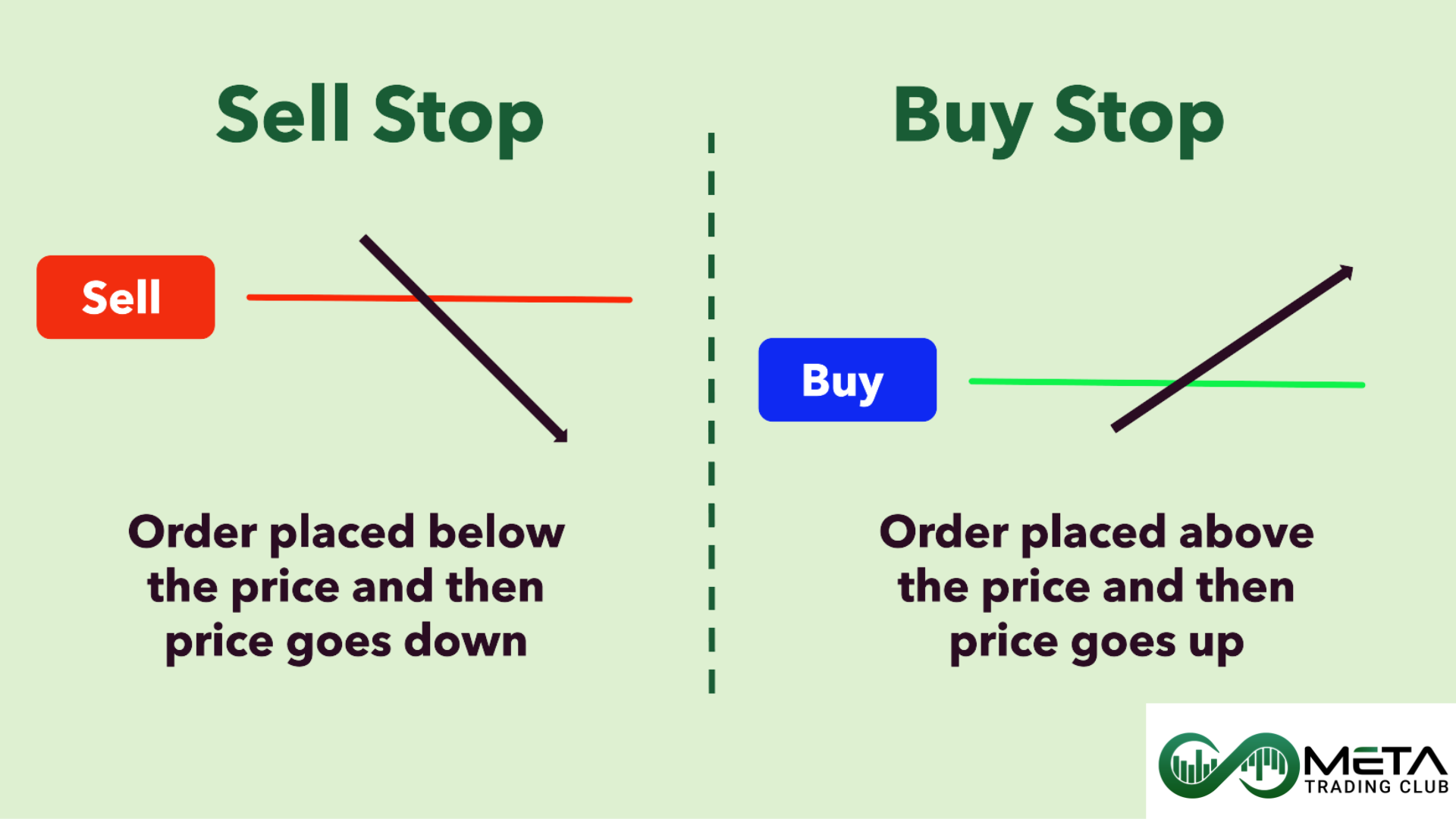

Stop Order

A stop order is an instruction to buy or sell a security once its price reaches a specified level, known as the stop price. Also, stop order (or stop-loss order) is designed to limit a trader’s loss on a position. It becomes a market order once the stop price is reached. This type of order is often used to protect profits or limit losses.

Here are types of limit orders:

Buy-Stop Order

This order is used to enter a position when the price rises to a certain level. Also, if you want to buy a stock but only if it reaches a certain price, you can place a stop-buy order above the current market price. Once the stock reaches this stop price, the order becomes a market order to buy.

Imagine you want to buy a stock currently trading at $40, but only if it rises to $45. You place a stop-buy order at $45. If the stock price reaches $45, the order will be executed as a market order to buy.

Sell-Stop Order

This order is used to enter a position when the price decreases to a certain level. Also, if you want to sell a stock but only if it reaches a certain price, you can place a stop-sell order above the current market price. Once the stock reaches this stop price, the order becomes a market order to sell.

Imagine you want to sell a stock currently trading at $40, but only if it rises to $35. You place a stop-buy order at $35. If the stock price reaches $35, the order will be executed as a market order to buy.

Stop-Loss Order

This order is used to limit a trader’s loss on a position. If you own a stock and want to protect against a significant drop in price, you can place a stop-loss order below the current market price. Once the stock reaches this stop price, the order becomes a market order to sell.

Suppose you own a stock trading at $50 and place a stop-loss order at $45. If the stock price falls to $45, the order will be executed as a market order, helping to limit your loss.

Trailing Stop Order

This order is used to protect gains by setting a stop price that trails the market price by a specified amount or percentage. Also, the stop price adjusts as the market price moves in your favor. However, if the market price moves against you, the stop price remains fixed, and the order becomes a market order when the stop price is reached.

Suppose you own a stock trading at $50 and set a trailing stop order with a $5 trail. If the stock price rises to $55, the stop price adjusts to $50. If the stock price then falls to $50, the order is executed as a market order to sell.

Example

Imagine you own shares of a company currently trading at $100:

- Stop-Loss Order: You could place a stop-loss order at $90 to limit your loss if the price drops.

- Buy-Stop Order: You could place a stop-buy order at $110 to buy more shares if the price rises.

- Trailing Stop Order: You could set a trailing stop order with a $10 trail to protect your gains as the price increases.

Pros and Cons

Pros

- Risk Management: Helps limit losses or lock in profits.

- Automation: Executes trades automatically when the stop price is reached, reducing the need for constant monitoring.

- Flexibility: Can be used to enter or exit positions based on market movements.

Cons

- No Price Guarantee: Once triggered, the order becomes a market order, which may result in execution at a price different from the stop price, especially in volatile markets.

- Market Fluctuations: Short-term price movements can trigger stop orders, potentially resulting in unwanted executions.

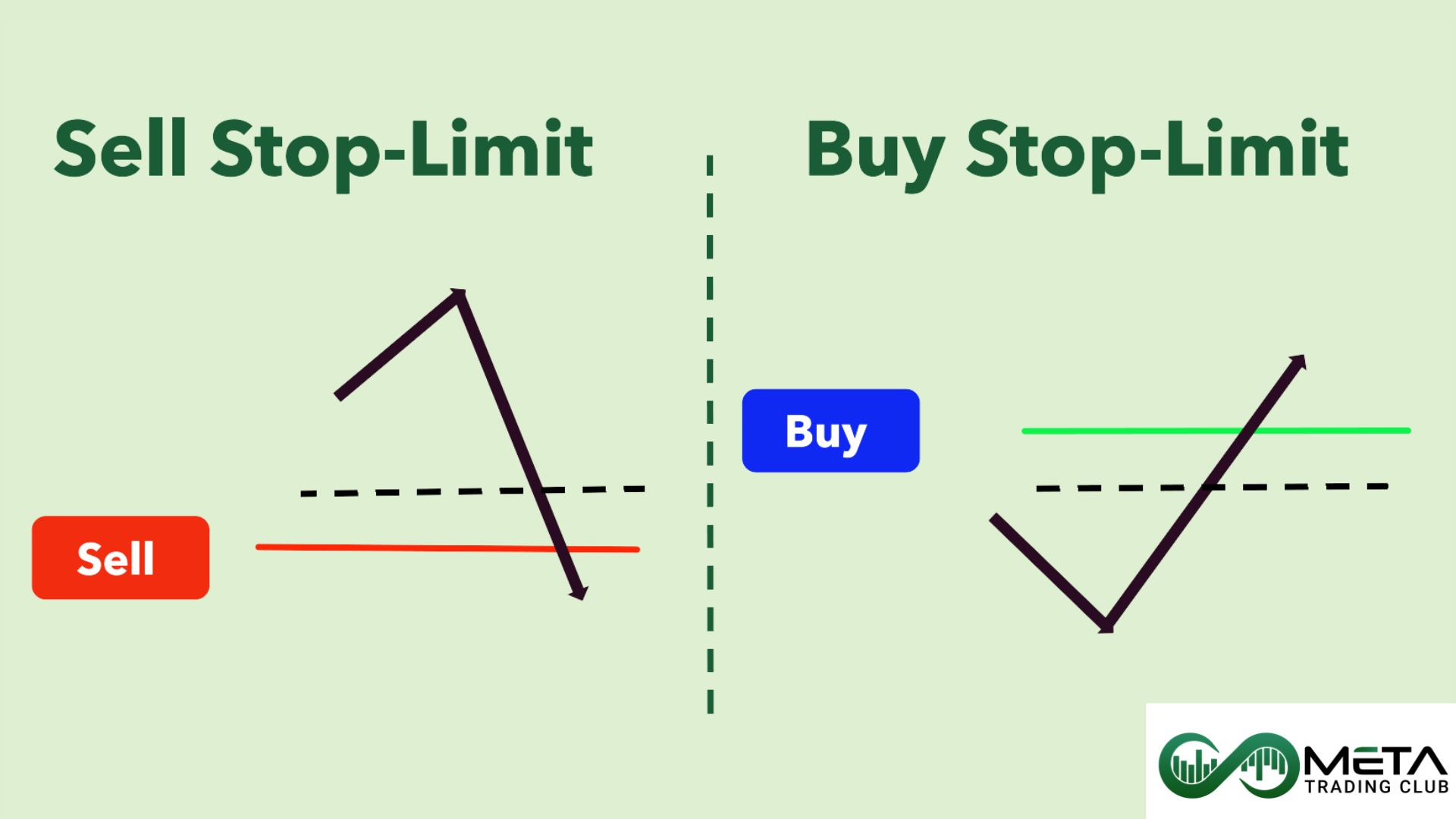

Stop-Limit Order

A stop-limit order is a type of conditional trade that combines the features of both stop and limit orders. It becomes a limit order once the stop price is reached. Also, this type of order is used to mitigate risk by providing more control over the execution price but does not guarantee execution.

The stop price is the trigger point at which the stop-limit order becomes active. Once the security’s price reaches or surpasses this level, the order is activated.

However, the limit price is the price at which you are willing to buy or sell the security once the stop price is reached. The order will only be executed at this price or better.

The stop-limit order remains inactive until the stop price is reached. Once the stop price is hit, the order becomes a limit order. After activation, the order will be executed at the limit price or better. If the market price does not reach the limit price, the order will not be filled.

Example

Imagine you own shares of a stock currently trading at $55, and you want to sell if the price drops but still control the minimum price you receive:

- Stop Price: You set a stop price at $50.

- Limit Price: You set a limit price at $48.

If the stock price falls to $50, the order is triggered and becomes a limit order to sell at $48 or better. If the price drops quickly and does not reach $48, the order will not be executed.

Pros and Cons

Pros

- Price Control: Provides precise control over the execution price, ensuring you do not sell for less or buy for more than your specified limit.

- Risk Management: Helps manage risk by setting predefined levels for triggering and executing trades.

Cons

- No Guarantee of Execution: If the market price does not reach the limit price after the stop price is triggered, the order will not be filled.

- More complex to set up compared to simple market or limit orders.

Order Duration

Order duration refers to the length of time an order remains active before it is executed or expires. Different types of order durations can be used depending on your trading strategy and goals. Understanding order durations can help you manage your trades more effectively and align them with your investment strategy. Here are the main types:

- Day Order (DAY): A day order is valid only for the trading day on which it is placed. If the order is not executed by the end of the trading day, it is automatically canceled.

- Good Till Canceled (GTC): A GTC order remains active until it is executed or manually canceled by the trader. This type of order can remain open for several days, weeks, or even months.

- Immediate or Cancel (IOC): An IOC order must be executed immediately. If it cannot be executed in full, the unfilled portion of the order is canceled.

- Fill or Kill (FOK): A FOK order must be executed immediately in its entirety. If the entire order cannot be filled immediately, it is canceled.

- Good Till Date (GTD): A GTD order remains active until a specified date. If the order is not executed by the end of the specified date, it is automatically canceled.

- At the Opening (OPG): An OPG order is intended to be executed at the opening of the trading session. If it cannot be executed at the opening, it is canceled.

- At the Close (MOC): An MOC order is intended to be executed at the close of the trading session. If it cannot be executed at the close, it is canceled.

Example

Imagine you place a GTC order to buy 100 shares of a stock at $45. This order will remain active until it is either executed at $45 or better, or you manually cancel it.

Final Words

Trade execution and order types are fundamental aspects of trading that significantly impact your trading outcomes. Understanding the various order types (such as market orders, limit orders, stop orders, and stop-limit orders) enables you to execute trades more effectively and manage risks better. Also, mastering these order types and understanding the nuances of trade execution can enhance your trading strategy, helping you achieve your financial goals more efficiently. Always stay informed and adapt your trading approach to the ever-changing market condition.

FAQs

A market execution trade is a type of order that is executed immediately at the current market price. This means the trade is filled at the best available price at the moment the order is placed.

Order execution in trading is the process of completing a buy or sell order on behalf of a client. This can be done manually or electronically, depending on the conditions set by the trader.

What happens after trade execution?

After trade execution, the following steps occur: You receive a confirmation of the trade details. Then, the transfer of the security and payment between buyer and seller is completed. Finally, the trade is recorded in your account and reflected in your portfolio.

A trade order is an instruction given by a trader or investor to a broker or trading platform to buy or sell a security, such as stocks, bonds, or derivatives. It specifies the details of the trade, including the type of order, the quantity, and the price at which the trade should be executed

The four main types of orders in trading are:

Market Order: Executes immediately at the current market price.

Limit Order: Executes at a specified price or better.

Stop Order: Becomes a market order once a specified price is reached.

Stop-Limit Order: Becomes a limit order once a specified price is reached.