Are you ready to join the fascinating world of trading? In this article, we’ll explore the concepts of long and short positions, helping you make informed decisions in the financial markets. If you are a curious beginner trader, this article will equip you with essential insights. Discover the profit potential of long positions when the market rises, and betting against the market with short positions. Assess the risks and rewards, and discover which path aligns with your risk appetite. Curious? Keep reading to master trading!

Table of Contents

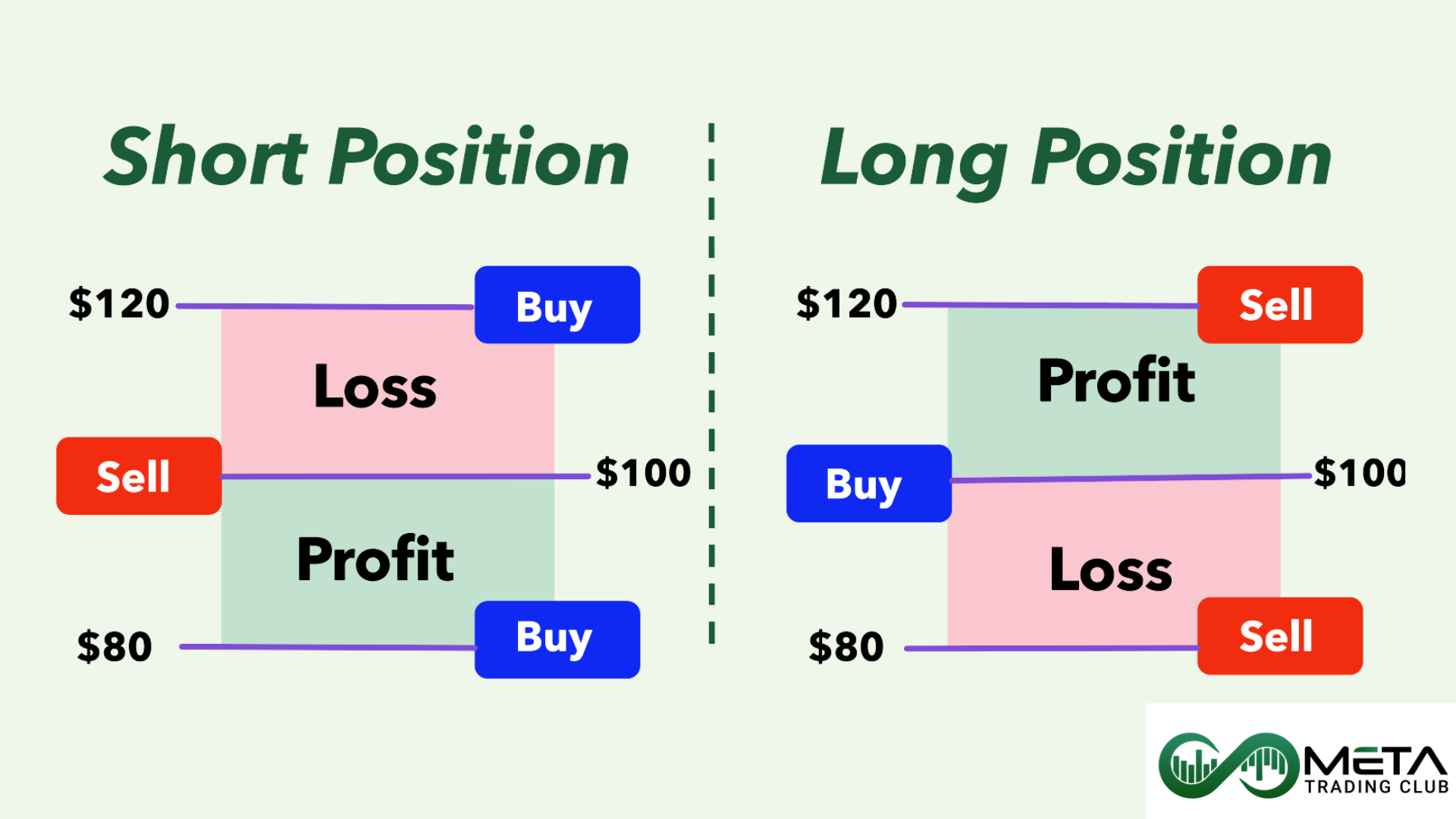

Long vs Short Positions

When a trader has a long position, it means they own and hold securities, such as shares of stocks. For instance, if someone owns shares of Tesla stock, he is considered long on Tesla’s shares. The goal here is to profit from rising stock prices. If the shares increase in value, the trader can sell them for more than they paid.

Long trades are common in bullish markets, where optimism about an asset’s future prospects prevails. For instance, if a trader believes a company’s stock will rise, they can enter a long position by buying the stock, with the intention of selling it at a higher price later. (Buy low and sell high)

Conversely, a short position occurs when a trader sells shares of a stock without actually owning them yet. For example, if a trader sells shares of Tesla without owning them, he is short on Tesla’s shares. The hope is that the stock price falls, allowing them to buy the shares back at a lower price and return them. However, if the price rises instead, the short seller may face a margin call from their broker.

Short trades are typically used in bearish market conditions or when a trader believes an asset is overvalued. For instance, if the trader thinks a stock is overhyped and will decrease in value, they can enter a short position, with the intention of buying it back at a cheaper price. (Sell high and buy low)

Both long and short trades come with their own risks and potential rewards, and they play a crucial role in portfolio diversification and risk management. It’s essential for traders and investors to have a deep understanding of these concepts to make informed decisions in the dynamic world of financial markets.

What Is a Long Position?

A long position refers to a trader purchase of an asset with the expectation that its value will increase (a bullish attitude). This can apply to various securities, including stocks, ETFs, Forex currencies, and derivatives like options and futures. When holding a long position, the trader anticipates future price appreciation and typically has no immediate plans to sell the asset. In options trading, being long can mean owning an option (either a call or a put) on an underlying asset, depending on the trader’s outlook.

When traders take a long position, they buy an asset (such as stocks, bonds, or commodities) with the expectation that its value will increase over time. In other words, they are optimistic about the asset’s future performance. The goal is to profit by selling the asset later at a higher price. Also, the trader becomes the legal owner of the asset.

For example, if you buy 100 shares of a company’s stock, you are long 100 shares. Also, the goal is to benefit from price appreciation. If the asset’s value rises, the trader can sell it at a higher price than the purchase price, making a profit. Moreover, long positions are typically held for the long term, allowing traders to participate in the asset’s growth over months or years. While long positions offer potential gains, they also carry risk. If the asset’s value declines, the trader may incur losses.

How Does the Long Position Work?

When a trader buys and owns shares of a stock or other securities, the trader owns a long position. Also, trader expects the value to rise, aiming for profits when they sell the shares in future. Here’s how it works:

- Expectation of price increase: As a trader, you believe that the value of the asset (such as a stock, currency, or commodity) will go up over time.

- Buying the asset: You purchase the asset, effectively going long. This means you’re hoping and expecting the asset’s value to increase.

- Profit potential: If your prediction is correct and the asset’s price rises, you can sell the asset at a higher price, making a profit.

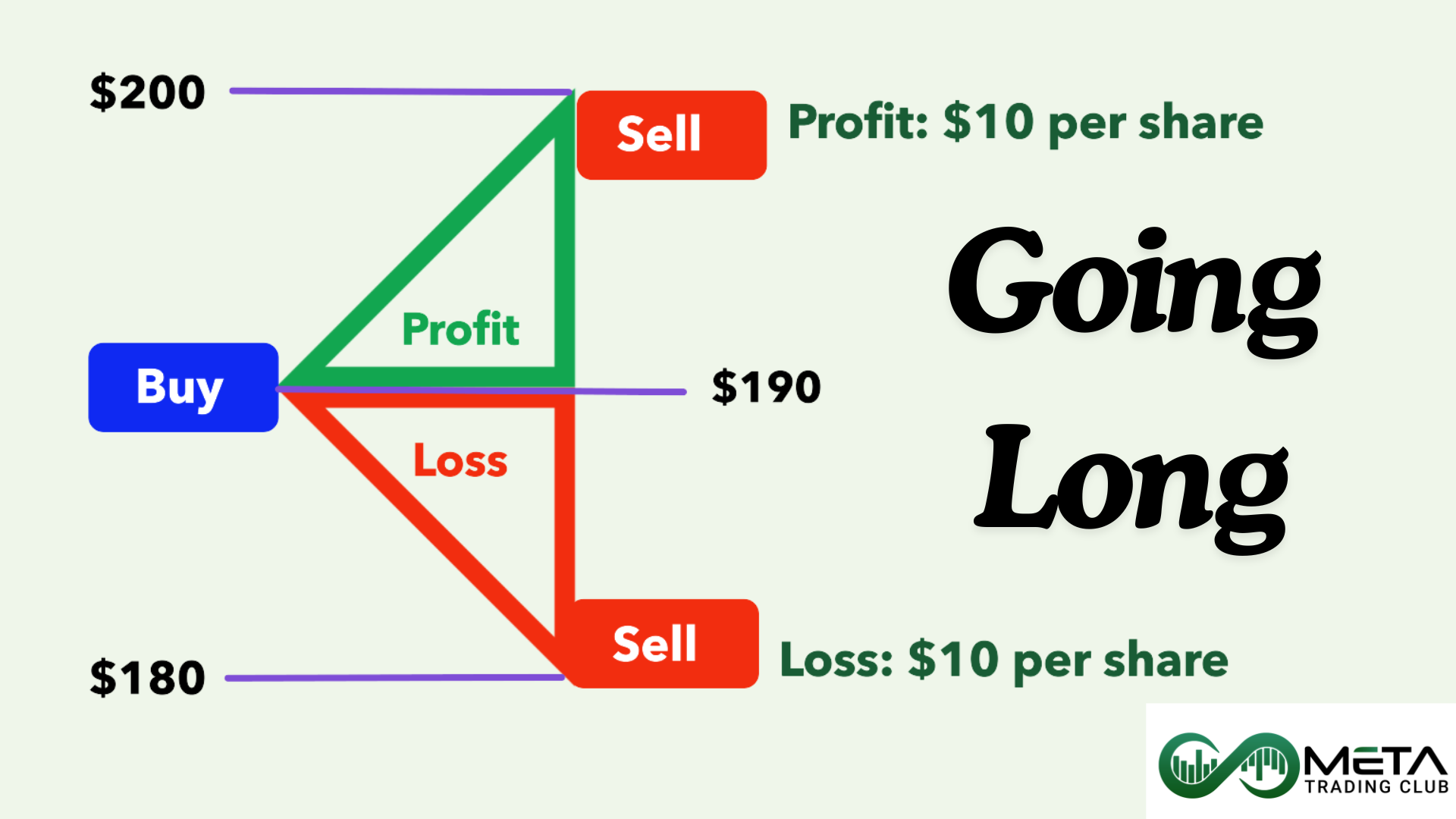

Example

Imagine you expect Amazon (AMZN) to increase in price from the current price of $190. So, you decide to purchase 100 shares of Amazon at $190 for your portfolio. In this example, you are “long” 100 shares of AMZN. Being long means you fully own these shares, having paid for their cost, and you anticipate that the stock price will rise over time. if the price rises to $200, you will profit $10 per share. Although If the price decreases to $180, you will make a loss of $10 per share.

Pros

Locks in a price:

When you take a long position, you lock in a specific purchase price for an asset. This can provide stability and predictability.

Limits losses:

Your losses are limited to the amount you invest in the stock. If the stock falls in price, your loss won’t exceed your initial investment.

Fits with market performance:

Long positions align with the historical upward trend of the stock market, which tends to rise over the long term.

Cons

Suffers in abrupt price moves:

Long positions can be vulnerable to sudden price drops or short-term market volatility.

May expire in options and futures:

Depending on the investment vehicle (such as options or futures), long positions may have expiration dates. If the advantage doesn’t materialize by then, you might miss out. (But long positions in stocks can be held for the long term, allowing traders to participate in the asset’s growth forever).

What Is a Short Position?

A short position refers to a trader selling an asset with the expectation that its value will decrease (a bearish attitude). This can apply to various securities, including stocks, ETFs, currencies, and derivatives like options and futures. Also, in a short position describes the position you’ll take when you think that an asset’s price will fall. However, in options trading, being short can mean selling an option (either a call or a put) on an underlying asset, depending on the trader’s outlook.

When traders take a short position, they sell an asset (such as stocks, bonds, or commodities) with the expectation that its value will decrease over time. In other words, they are pessimistic about the asset’s future performance. The goal is to profit by buying the asset later at a lower price. Also, shorting refers to short selling a stock in order to profit on its decline. Traders refer to those with such a position as “shorts.” The key thing to remember here is that when you’re short something, you have a negative position in it.

If you sell 100 shares of a company’s stock when you are not owning the stocks, you are short 100 shares. Also, the goal is to benefit from price depreciation. If the asset’s value decreases, the trader can buy it at a lower price than the shorting price, making a profit. Furthermore, short positions are typically held for the very short term, because holding a short position has further costs. While short positions offer high potential gains, they also carry risk. If the asset’s value rises, the trader may become margin call.

How Does the Short Position Work?

The short position occurs when a trader sells shares that don’t own yet. Also, the trader aims to buy them back at a lower price, profiting from the stock’s decline. Here is how it works:

- Expectation of price decline: As a trader, you believe that the value of the asset (such as a stock, currency, or commodity) will go down over time.

- Selling the asset: You sell the asset you don’t own, effectively going short. This means you’re hoping and expecting the asset’s value to decrease.

- Profit potential: If your prediction is correct and the asset’s price declines, you can buy the asset at a lower price, making a profit.

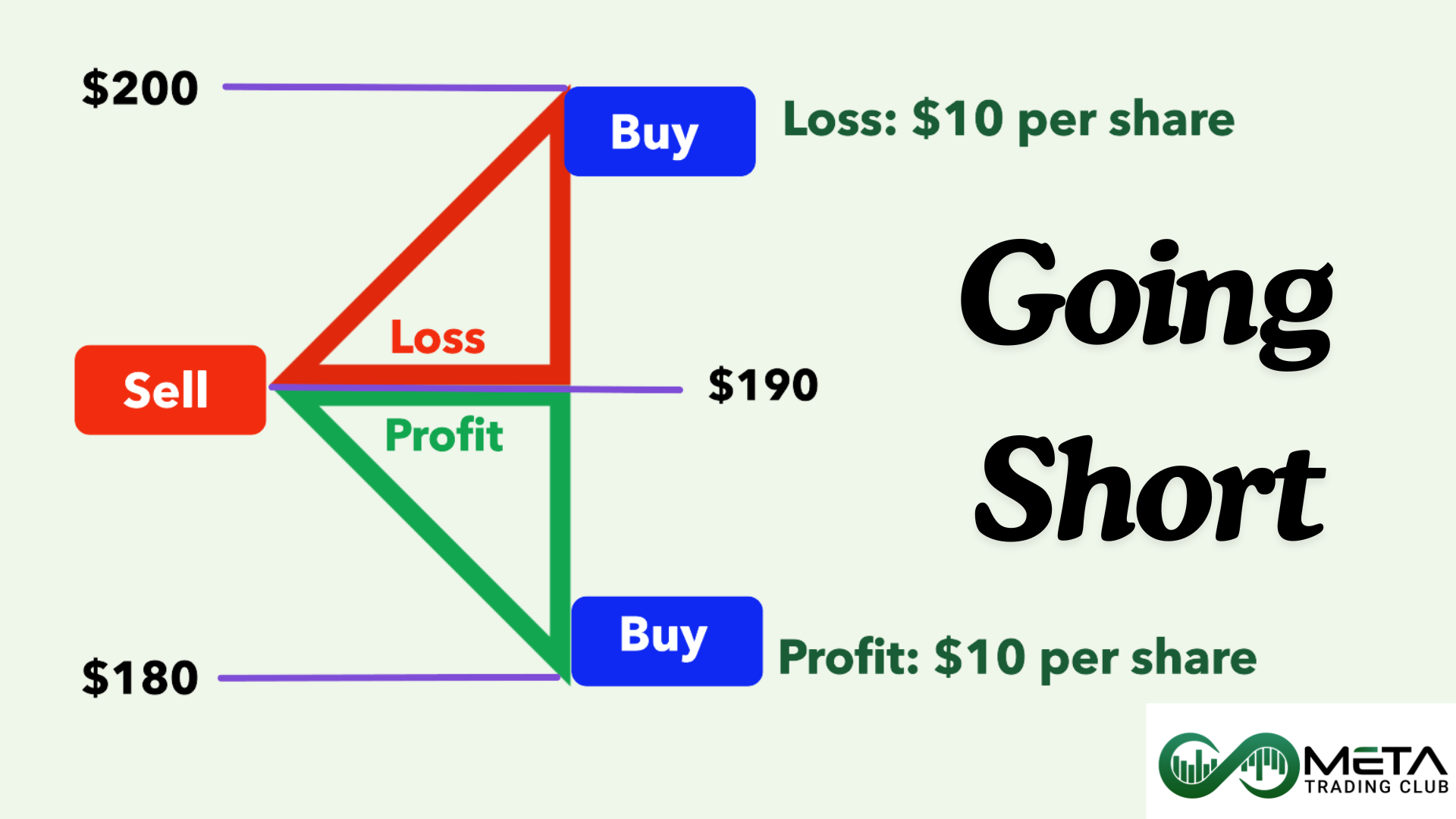

Example

Suppose Tesla (TSLA) shares are traded at $190, and you think Tesla is overvalued. In addition, you expect the stock’s price to decrease. So, you decide to sell 100 shares of stock at $190 (which do not exist in your portfolio). In this example, you are “short” 100 shares of Tesla. Being short describes the position you’ll take when you think that an asset’s price will fall. If the price decreases to $180, you will make a profit of $10 per share. Although if the price rises to $200, you will lose $10 per share.

Pros

Profit from price declines:

Short sellers bet on falling stock prices and can profit when the value of a security decreases.

Opportunities in bear markets:

Short positions tend to work better during bear markets, where stocks decline more rapidly.

Enhances skepticism:

By analyzing weaknesses in companies, short sellers develop a critical eye and skepticism, which can benefit overall trading decisions.

Cons

Unlimited losses:

Unlike long positions, where losses are capped, shorting exposes traders to potentially limitless losses if the stock price rises significantly.

Riskier than buying:

Short selling carries higher risk due to the possibility of unexpected price spikes and the need to buy back shares at a higher cost.

Final Words

Long trading and short trading (betting on price declines) each have their merits and risks. Long position trading allows traders to lock in specific entry prices, limit losses, and align with historical market trends. However, it requires patience and can be vulnerable to abrupt price changes. On the other hand, short position trading profits from falling prices and works well during bear markets. Also, it fosters skepticism but carries higher risk due to unlimited potential losses. Both approaches can be valuable when executed wisely.

Choose your trading strategy based on your risk tolerance, time horizon, and market outlook. Want to discover how to build a trading strategy, participate in our incubator program.

Whether you’re bullish or bearish, understanding long and short positions is essential for successful trading. Remember that going long reflects optimism about an asset’s growth, while shorting involves betting against it. Choose your strategy wisely, manage risks, and may your trades be profitable!

FAQs

Long Position: A trader who buys and owns shares of a stock or other securities is said to be in a long position. They expect the value to rise, aiming for profits when they sell the shares in future.

Short Position: Conversely, a short position occurs when a trader sells shares they don’t own yet. They aim to buy them back at a lower price, profiting from the stock’s decline.

A short position occurs when a trader sells a security they don’t own, aiming to buy it back at a lower price later. For example, a trader shorts shares of Amazon and sells them at $180, and hopes to profit as the stock price falls.

A long position refers to purchasing an asset with the expectation that its value will increase (bullish attitude). In options contracts, it indicates the holder owns the underlying asset.Similarly, in futures contracts, going long obliges the holder to buy the underlying instrument at the contract price upon expiry.

Traders often hold long positions in stocks or bonds indefinitely, following a “buy and hold” strategy. But in options and futures, a long position’s duration depends on the contract’s expiration date and the trader’s outlook for the underlying asset.

In trading and investing, a long position refers to buying an asset with the expectation that its value will increase over time. Essentially, it’s a bullish stance where you hold an asset in anticipation of future gains.