Last week’s market and economic data key points:

- Biden stepping aside from reelection

- GDP growth rises 2.8%

- PCE inflation rises moderately in June

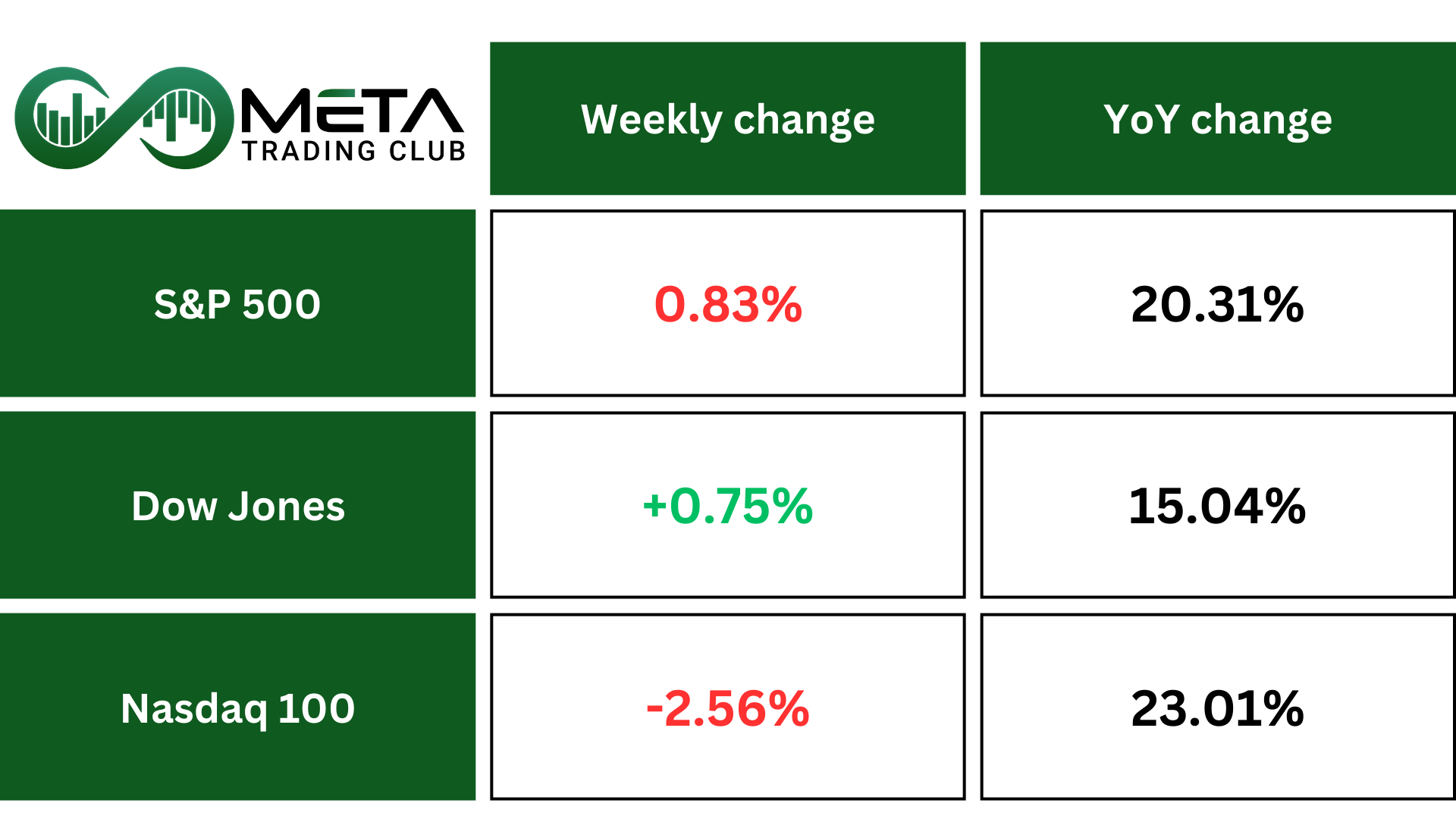

- Dow up 0.8%, S&P down 0.8%, Nasdaq down 2.1%

- S&P 500’s turbulent week ends with stocks rallying after PCE report

- Alphabet down but Q2 revenue & profit beat expectations

- Tesla’s earnings missed estimates, shares dropped

- IBM posts upbeat earnings

- Coca-Cola’s stock rises after another profit beat

- Visa’s stock falls as volume growth slows

- Coursera stock soars 48% this week due to good earnings

- Yen extends gains toward ¥152

- The Paris Olympics started and will cost an estimated $8.2 billion to host

Table of Contents

Last Week’s Reports

Economic Reports

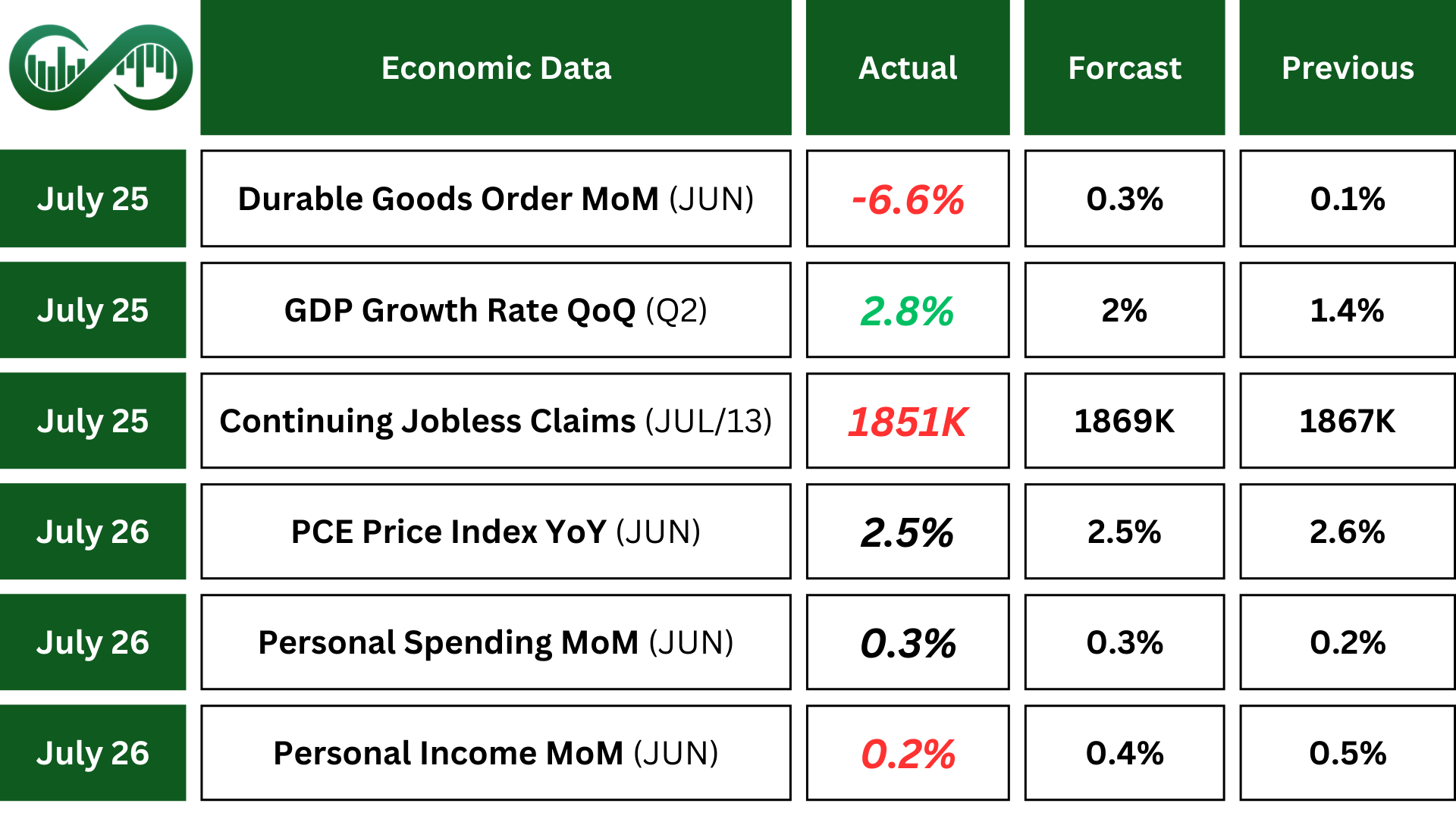

US durable goods orders unexpectedly fell in june. New orders for manufactured durable goods in the US declined 6.6% MoM, after four consecutive monthly increases and missing market expectations of a 0.3% increase.

Also, the inflation expectations in the United States fell for the second straight month to 2.9% in July, the lowest since March.

The US economy expanded in Q2, GDP growth rose from 1.4% in Q1 to 2.8% (above advanced forecasts of 2%).

Moreover, US jobless claims drop more than expected in last week’s reports. Despite this decline, the claim count remained above this year’s average, indicating that although the US labor market is still tight.

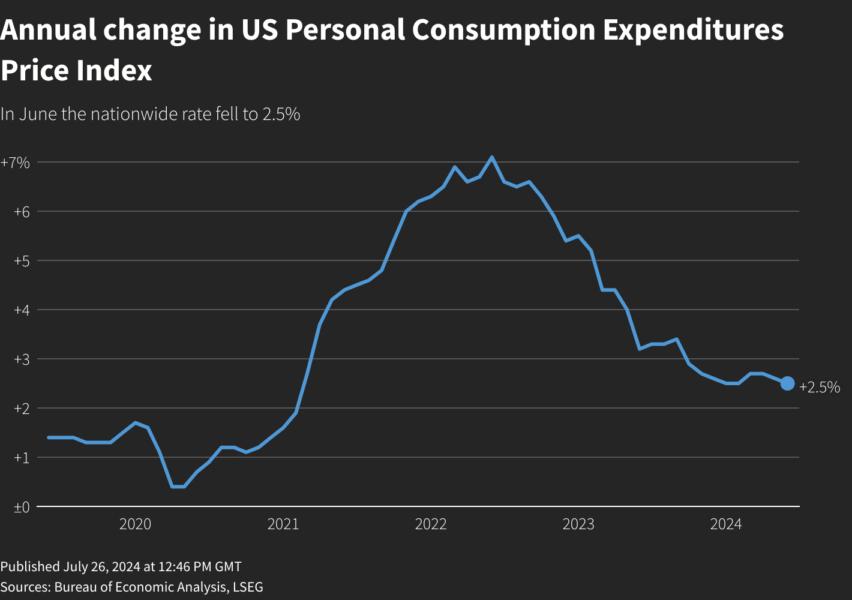

The Personal Consumption Expenditure (PCE) price index rose 0.1% MoM in June. Meanwhile, the annual PCE rate is slowing for a second consecutive month to 2.5% from 2.6% (a new low since March 2021).

Image source: Thomson Reuters

The yield on the 10-year Treasury bond fell to 4.23% on Friday as markets assessed personal spending and personal income data at a narrower range while continuing to gauge the impact of Federal Reserve’s policy outlook.

Earning Reports

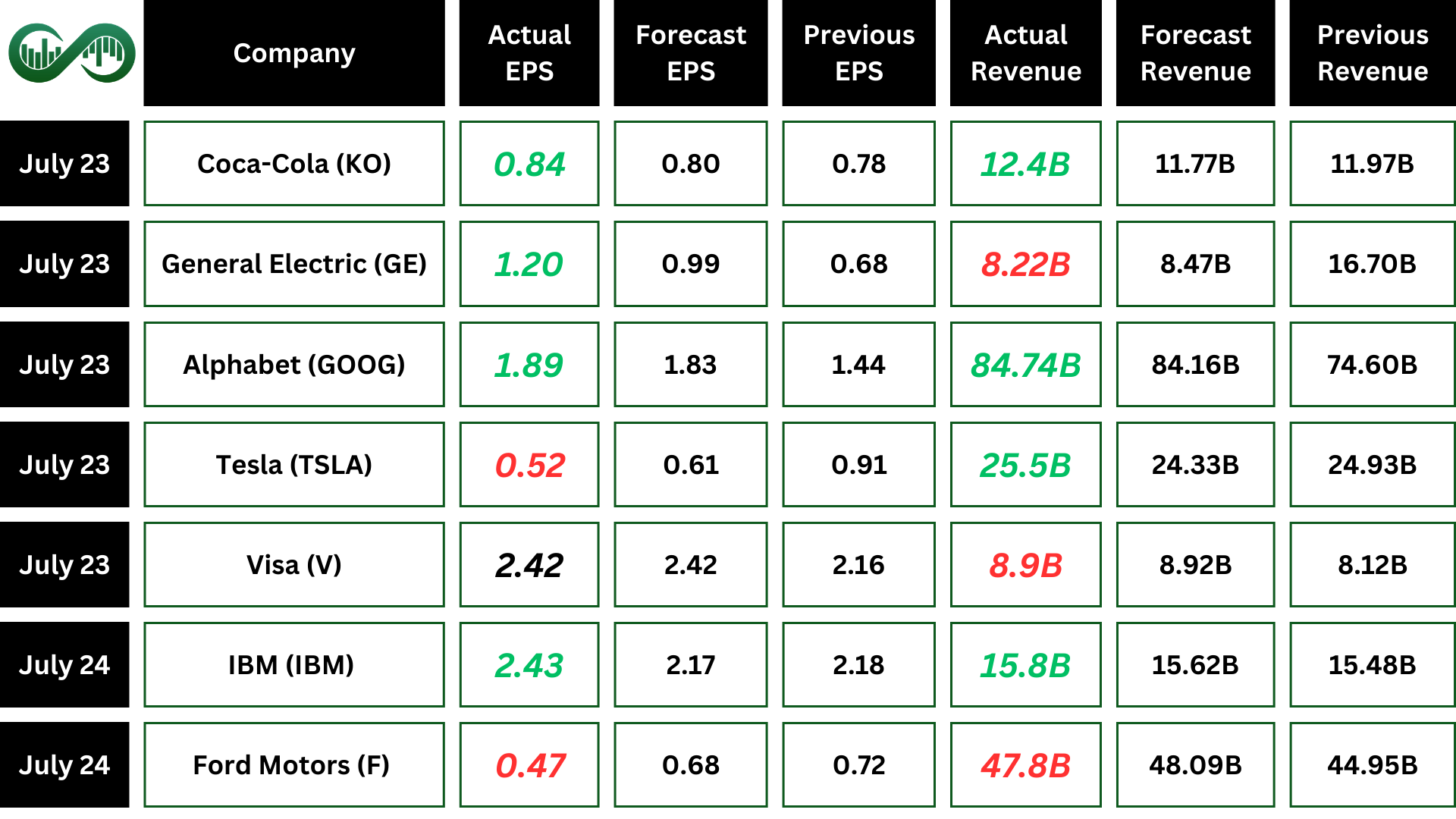

Coca-Cola

Coca-Cola (KO), the beverage giant beat 2Q earnings expectations and raised its full year outlook, amid increases in prices and sales. Also, unit case volume rose, as growth in Latin America and Asia offset a decline in North America.

However, net income fell to $2.41 billion from $2.55 billion in the same period a year ago.

Also, revenue grew 3.3% and concentrate sales increased 6%, amid particular strength in the Latin American and Asia Pacific regions. Moreover, KO said the company was also using technologies enhanced by AI, in an effort to boost sales.

Alphabet

Alphabet (GOOG) reports Q2 revenue of 14% YoY, beating estimates. Also, rise in earnings driven by strong advertising sales (rose 11%) and robust demand for cloud computing services (jumped 28.8%). However, revenue from YouTube increased 13%, but fell short of estimates.

Strong advertising sales fueled by events such as the Paris Olympics and elections in multiple countries, including the United States. However, this is a slowdown in Google’s advertising growth versus a 13% gain in the previous period.

Moreover, the company reported capital expenditures of $13 billion. However, Alphabet is in the process of reengineering its cost base, with a focus on moderating expenses and allocating resources towards AI initiatives.

Meanwhile, Google expanded AI-powered summaries in Search and enhanced its Gemini AI model to better compete with rivals such as OpenAI and Microsoft.

GOOG is in the oversold zone in the RSI indicator. Meanwhile, the price reached a static support zone (the recent support) which is a dynamic support of the 100-day moving average and at the same time the 50% retrace of the recent uptrend. As the company has released a strong report, we expect the price to rise from here. However, if price breaks the strong support, the price can decline to the 200-day MA.

Tesla

Tesla (TSLA) company’s 2Q earnings fell short of market expectations, impacted by lower vehicle prices and restructuring charges. Also, Tesla’s revenue rose 2% YoY to $25.5 billion (highest ever). Moreover, the automotive revenue component had a sequential 14.4% rise.

Furthermore, the company made an operating profit of $1.6 billion. However, this included $890 million in regulatory tax credits. That represented over half of the operating income. This could be another reason why the market was disappointed.

In addition, Tesla remains profitable and produces positive cash flow (no other EV manufacturer can).

Visa

Visa (V) shares were falling after the credit-card company’s quarterly results failed to impress. The company reported 3Q earnings of $2.42 per share and revenue of $8.9 billion fell slightly short of forecasts.

Payment’s volume rose 7% (last quarter was 8% growth), while processed transactions rose 10% (declined from11% growth in last quarter). For the full year, the company continues to expect low double-digit net revenue growth.

The results underscore the challenges the industry is facing after several quarters of growth as inflation and high borrowing costs prompt a large section of customers to cut back on purchases, while wage growth loses steam.

IBM

IBM (IBM) came out with quarterly earnings of $2.43 per share, beating the estimates. This compares to earnings of $2.18 per share a year ago. Also, this quarterly report represents an earnings surprise of 12.50%. However, over the last four quarters, the company has surpassed consensus EPS estimates four times.

U.S. Election

President Biden publicly addressed the nation that he’d withdrawn from the 2024 campaign for a pending re-election.

He explained things he’s done since being elected, but he also said the election is up to the ‘American people,’ just a moment after he gave his endorsement to Vice President Kamala Harris as his successor.

Image source: Timesnownews

Former President Donald Trump on Saturday laid out his plans for cryptocurrency at the Bitcoin 2024 conference (how radically his position on cryptocurrency has changed over time). He promised to remove Securities and Exchange Commission Chair Gary Gensler if elected and implement a crypto advisory council.

He said, “We will have regulations, but from now on the rules will be written by people who love your industry, not hate your industry,”.

Paris Olympics

The Olympic games have started in Paris and will cost an estimated $8.2 billion to host.

The Olympic partner program includes longtime sponsors Coca-Cola Co, Visa, Alibaba Group (which have both been worldwide Olympic partners since 2017), Airbnb (which became a partner in 2019) and the company’s Corona Cero will be the global beer sponsor of the Olympic Games.

Toyota Motor became the Olympics’ first-ever mobility partner in 2015. In May, Japan’s Kyodo News reported that the automaker will end its top-tier Olympic sponsorship deal after the Paris games.

Indices

Indices’s Weekly Performance:

U.S. stocks bounced Friday after a turbulent week for the S&P 500, as investors weighed fresh data on inflation from the Federal Reserve’s favored gauge. The inflation report renewed investor optimism that the Fed may start cutting interest rates as soon as September.

Still, the S&P 500 booked a weekly loss of 0.8%, dragged down by slumping Big Tech stocks such as Google, chip maker Nvidia and EV maker Tesla.

From a technical point of view, the S&P500 reached a critical price range. Also, the index broke the trend line and had pulled back to that (a failure breakout or correct one??). Moreover, the price reached its static support zone. In addition, the next week’s earning report will set the next market movement.

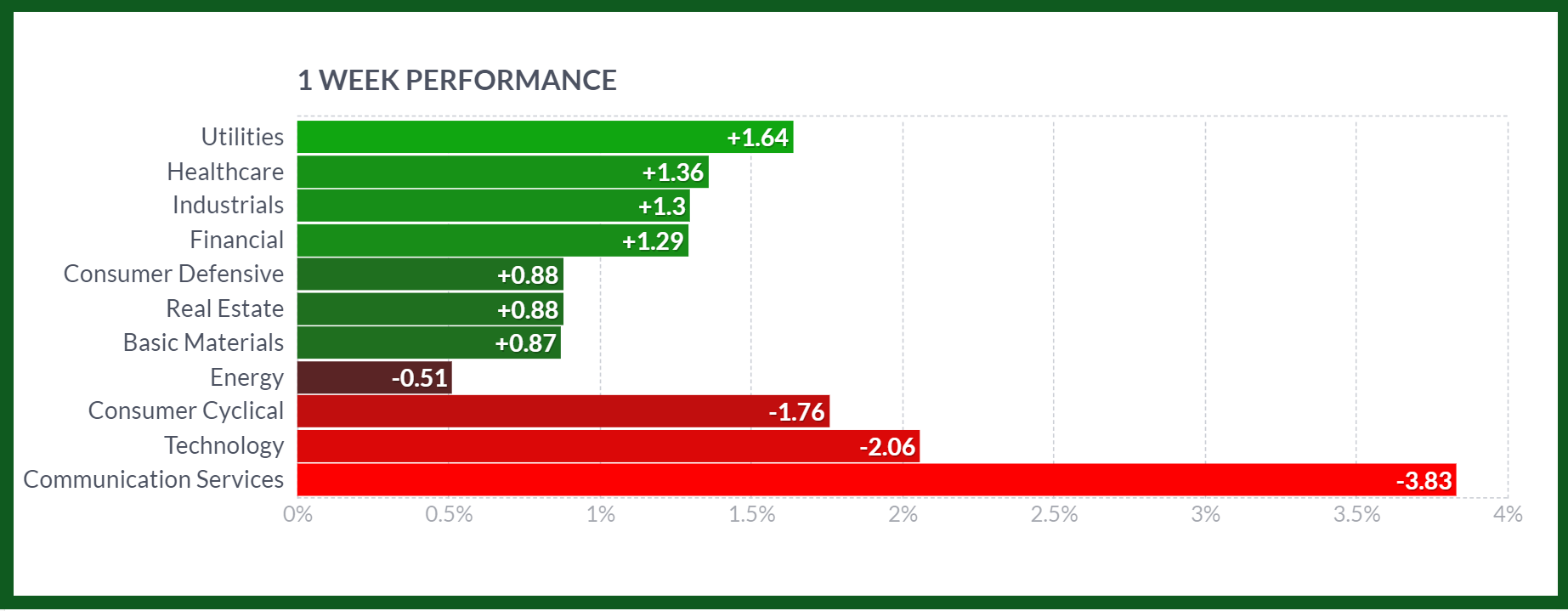

Stocks

Stock Market Sector’s Weekly Performance:

Source: Finviz

Stock Market Weekly Performance:

Source: Finviz

Five members of the so-called Magnificent Seven rose on Friday, led by Meta which climbed 2.7%. But their weekly performance was not eye-catching. Alphabet dropped 6% on the week, while Nvidia sank 4% and Tesla tumbled 8%, Microsoft and Apple declined around 2.8%, Meta downed for 2.3% and Amazon remained unchanged.

With further Magnificent Seven earnings due next week, the immediate outlook for markets may hinge on what type of results these companies deliver.

CrowdStrike’s software update took down a good portion of the internet starting on Friday, July 19, and it took until yesterday to get 97% of the problem resolved. CrowdStrike’s problem was also Delta’s problem — the outages forced the airline to cancel some 6,700 flights, as it proved incapable of responding as quickly as its peers. CrowdStrike (CRWD) stock has fallen 34% this month, while Delta has declined 8.4%.

Up 128% YTD, Should You Still Invest in Nvidia Stock?

To put this into perspective, Nvidia (NVDA) has surged approximately 128% year-to-date and an impressive 583.8% over the past two years. This remarkable ascent even propelled Nvidia to briefly surpass Microsoft (MSFT) as the most valuable company in the U.S. in terms of market capitalization.

While Nvidia delivered massive gains, its impressive rally has led to valid concerns about whether its stock can maintain its momentum, or if it is time to reconsider investments at these elevated levels.

NVDA shares reached a 100-day moving average which made a cluster support zone with statistical support and the trend line dynamic support. If NVDA breaks the trend line, we expect the price to decline to the 200-day moving average that has overlap with the important Fibonacci retracement zone of 61.8% at $78. Also, if the price goes up, notice that there is a resistance between $135-$140.

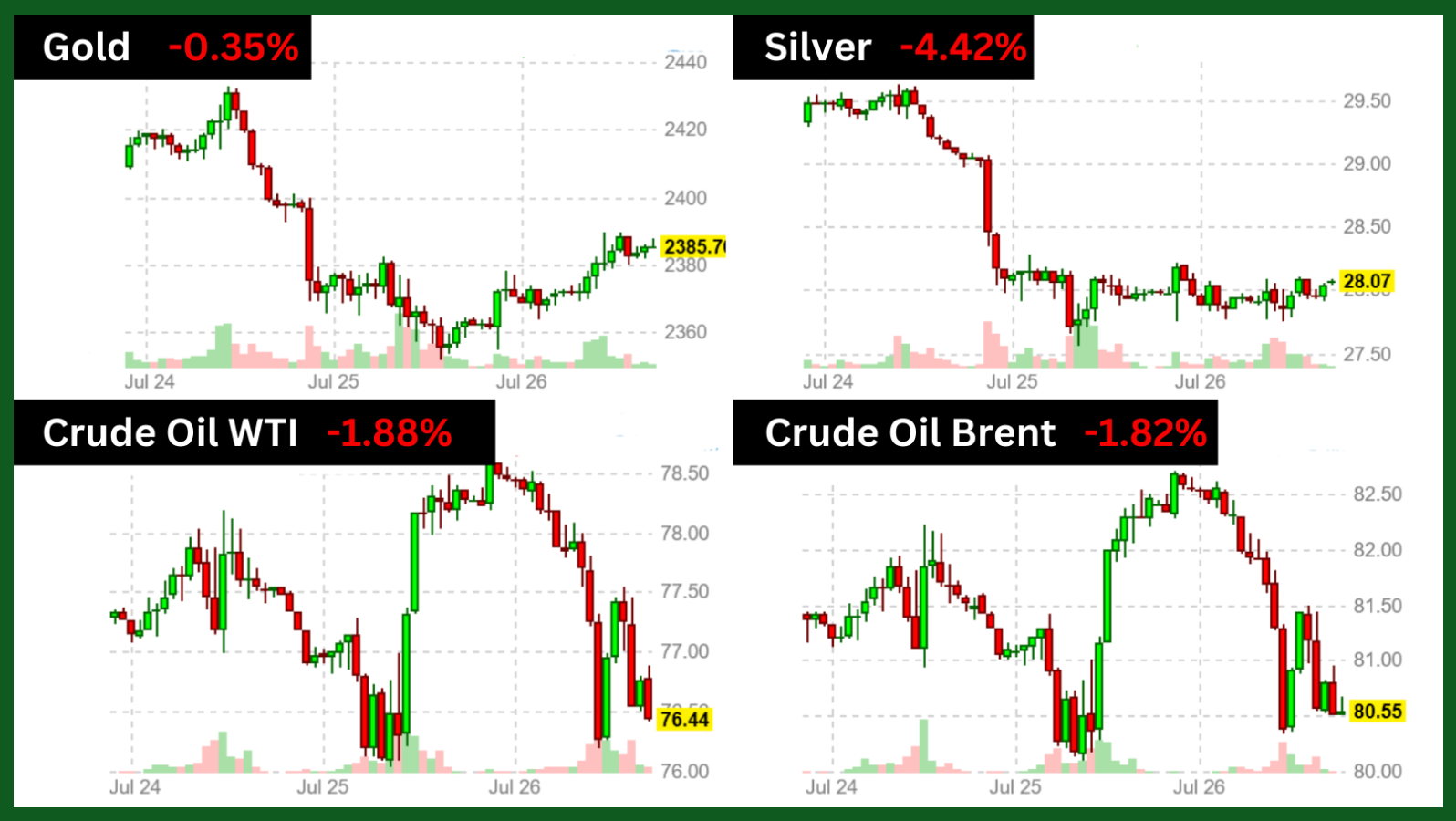

Commodity

Weekly Performance of Gold, Silver, WTI and Brent Oil:

Source: Finviz

Gold ended higher on Friday but tallied a second weekly loss in a row as the precious metal got caught up in the broad drop in risk assets after climbing last week to fresh record-high prices.

The Federal Open Market Committee meeting next week will help to set direction for gold. For now, precious metals are finishing their price consolidations here.

Meanwhile, China’s central bank is pausing their official gold purchases. Also, India announced a massive reduction in import duties for both gold and silver. The reduction from 15% down to 6%, along with an increase in capital-gains taxes for certain financial products This will likely surge physical demand for these metals and help support gold and silver prices.

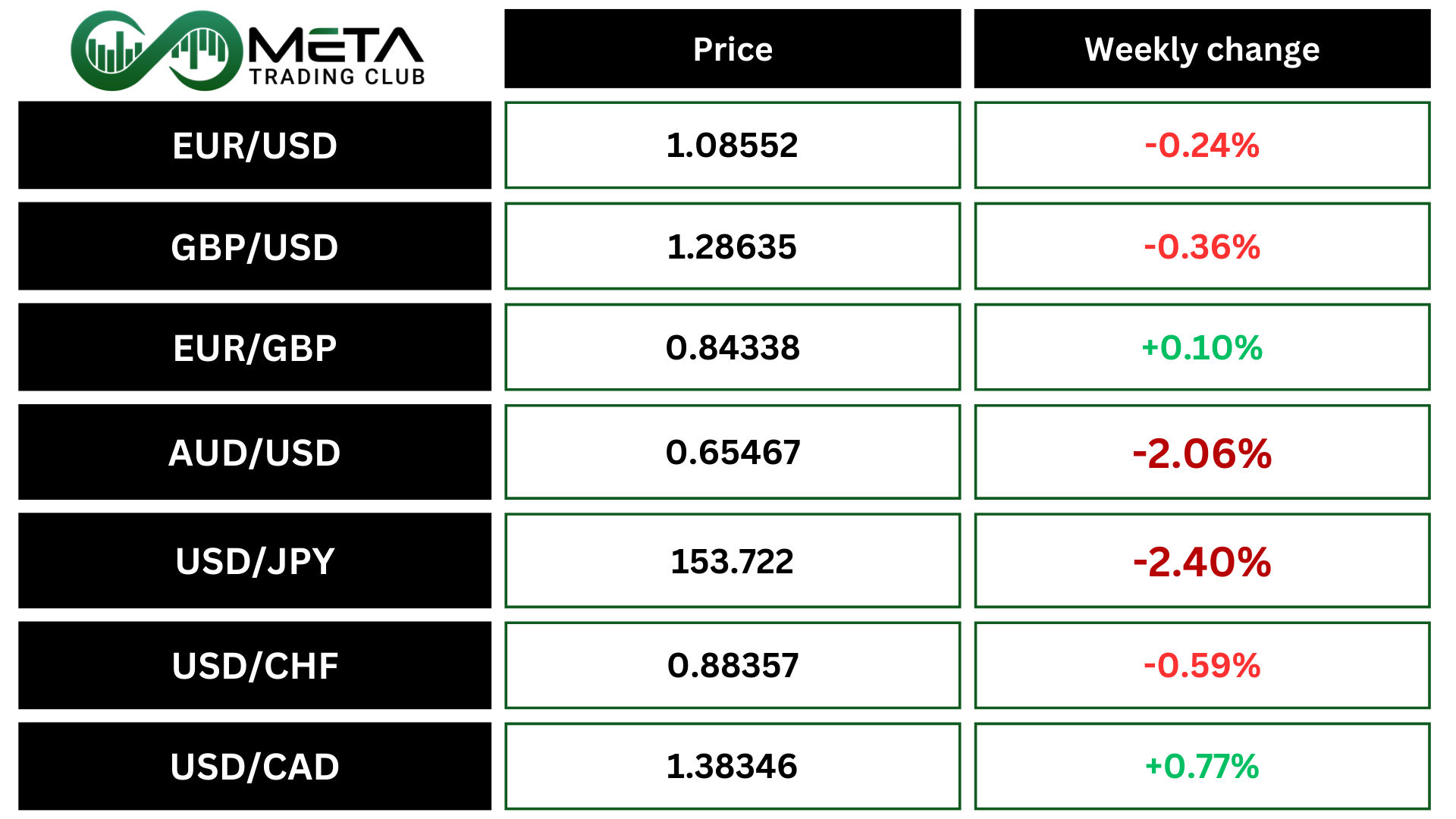

Forex

Weekly Performance of Major Foreign Exchange Pairs:

USD/JPY pair extended its drop for a fourth consecutive session, giving Japanese yen bulls a reprieve after heavy battering. Since Monday, the dollar-yen has fallen more than 2% as the yen is making efforts to get back on its feet. The Japanese currency has narrowed down to more than 10% loss on the year.

GBP/USD strengthened 0.16% to $1.2871. The Bank of England will also hold a policy meeting next week, although uncertainty surrounds what action the central bank may take with regard to rates.

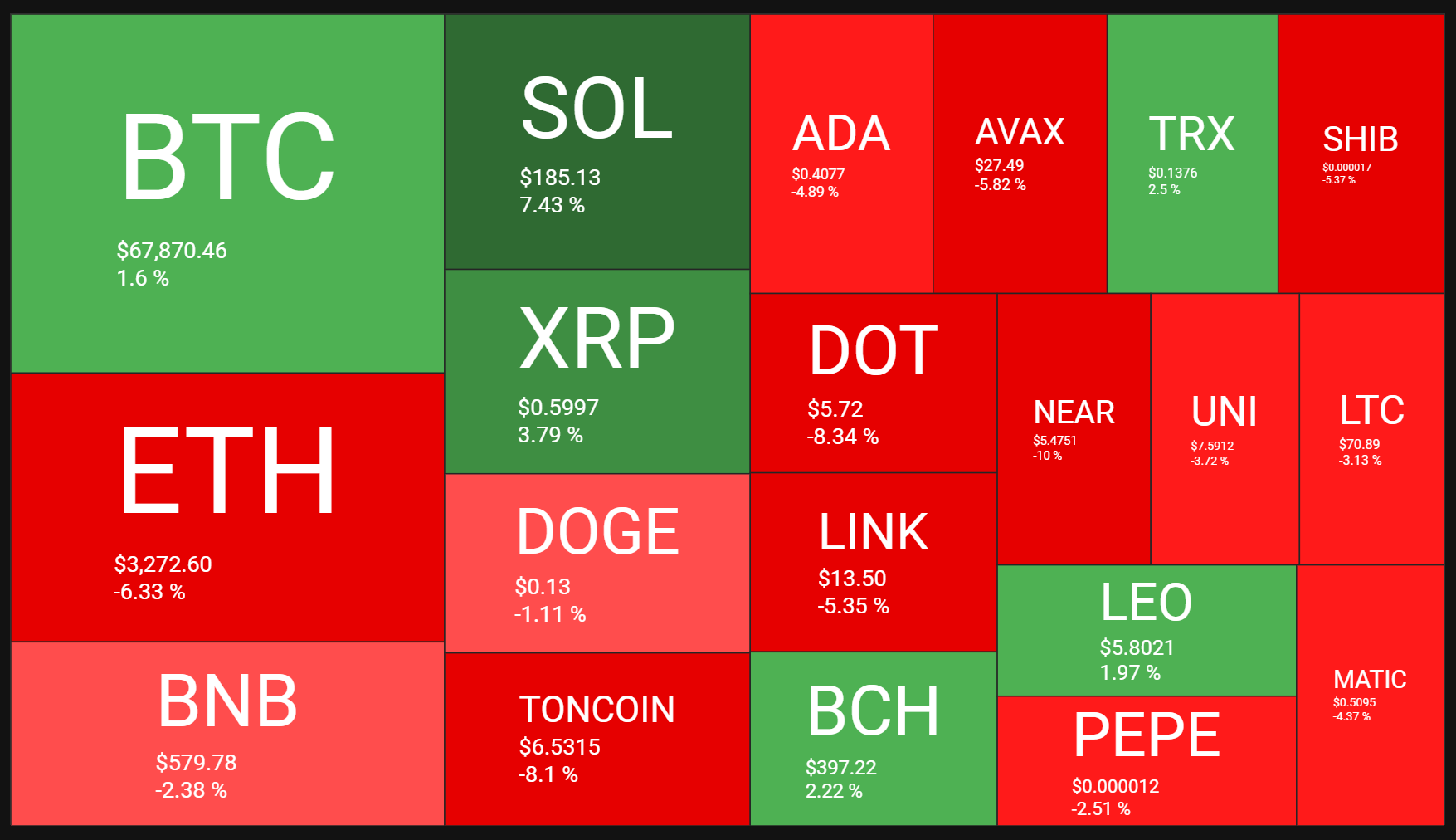

Crypto

Crypto Market Weekly Performance:

Source: quantifycrypto

U.S. Senator Cynthia Lummis plans to introduce legislation calling for a “strategic bitcoin reserve” that will reduce the national debt of the United States by buying 1 million bitcoin over the course of five years. Also, the bitcoins would be held for at least 20 years, she said.

Donald Trump’s keynote speech at the Bitcoin 2024 conference in Nashville, Tennessee didn’t act as the whale call some analysts may have predicted, but its impact may yet be felt as word gets out.

Trump announced, “It will be the policy of my administration to keep 100% of all the bitcoin the US government currently holds or acquires into the future. This will serve in effect as the core of the strategic national bitcoin stockpile…It’s been taken away from you.”

Trump also reiterated promises that the U.S. government is developing a Central Bank Digital Currency (CBDC). Trump also spoke favorably about developing stablecoins in the United States and supporting the bitcoin mining industry.

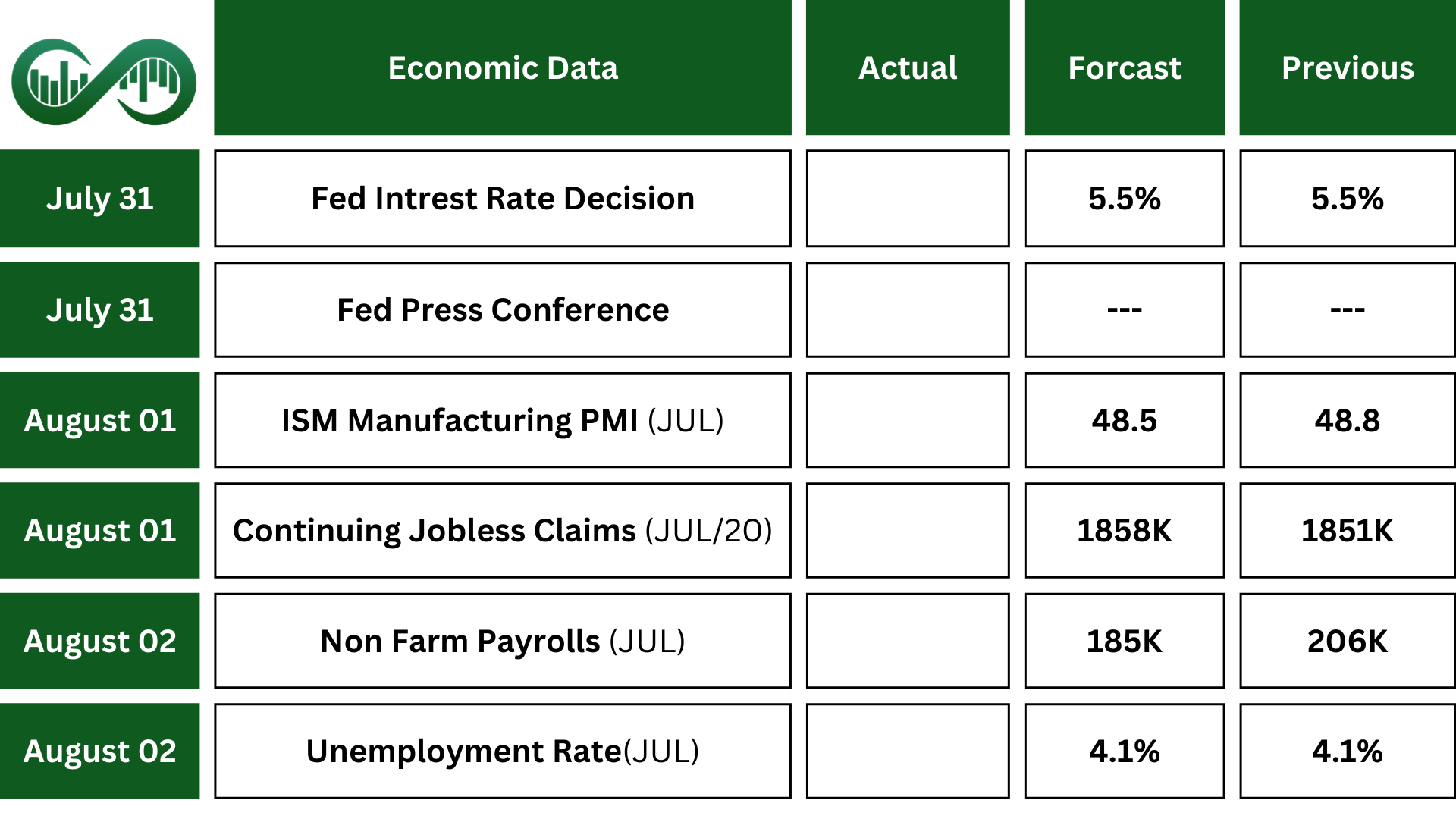

Next Week’s Outlook

Economic Events

In the United States, the Fed is expected to keep the fed funds rate steady at 5.25%-5.50% for an 8th consecutive meeting, but all eyes will be on any sign about the central bank’s plans for September, with a rate cut totally priced in.

Also, unemployment rate probably remained at 2021-highs of 4.1% and wage growth at 0.3%.

In addition, the ISM PMI is expected to show the manufacturing sector remained in contraction for a 3rd month.

Moreover, traders will be paying close attention to the quarterly refunding announcement to assess the federal government’s borrowing requirements and upcoming strategies for note and bond sales.

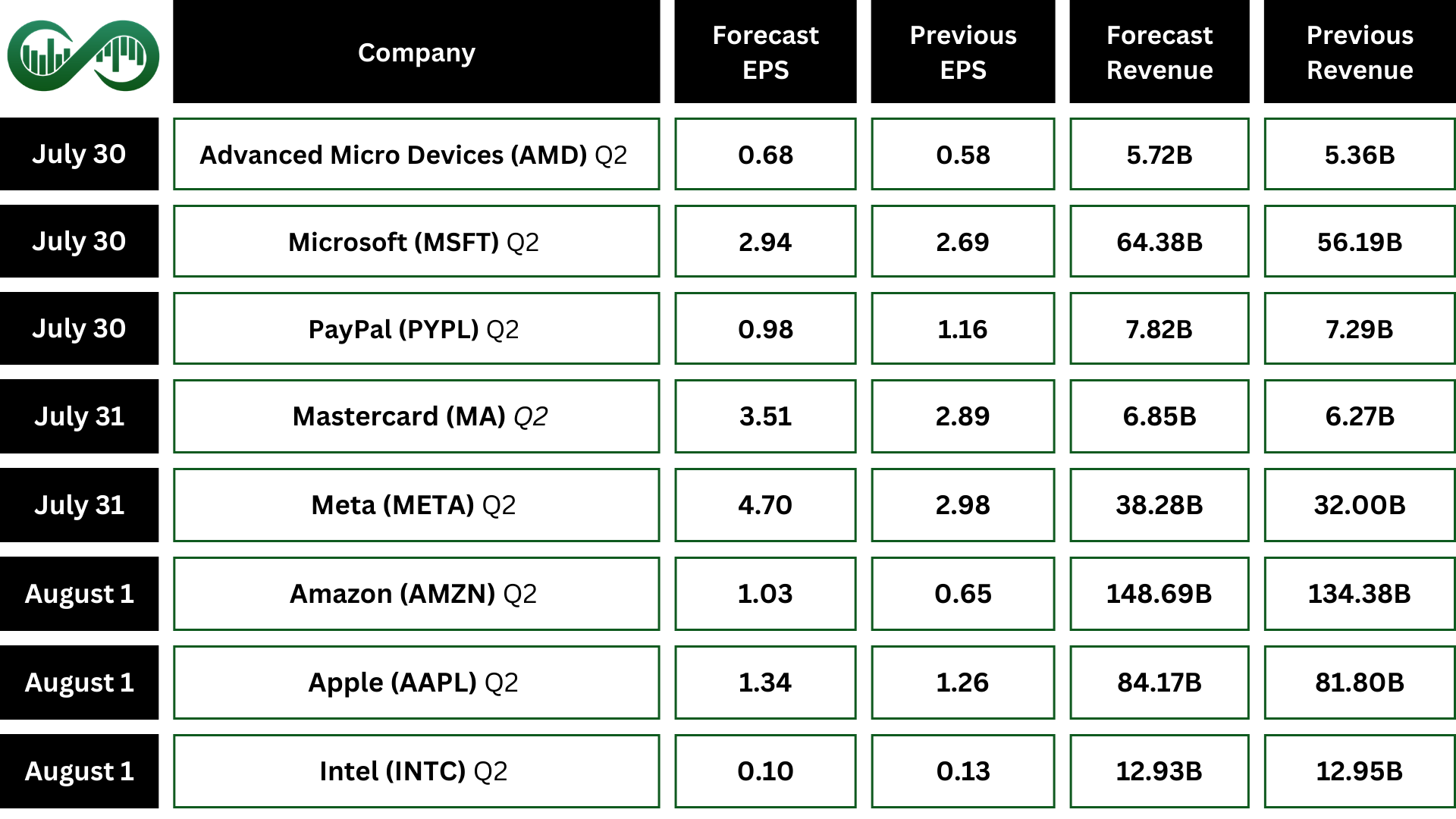

Earning Events

The earnings season will continue with reports from mega caps Microsoft, Apple, Amazon and Meta alongside McDonalds, P&G, Merck, Toyota, AMD, Caterpillar, Pfizer, S&P Global, Stryker, Airbus, Mastercard, T-Mobile, Qualcomm, HSBC, Boeing, Intel, Exxon Mobil, Chevron, Linde.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.